Heterogeneous Demand

UCSD MGT 100 Week 06

Let’s reflect

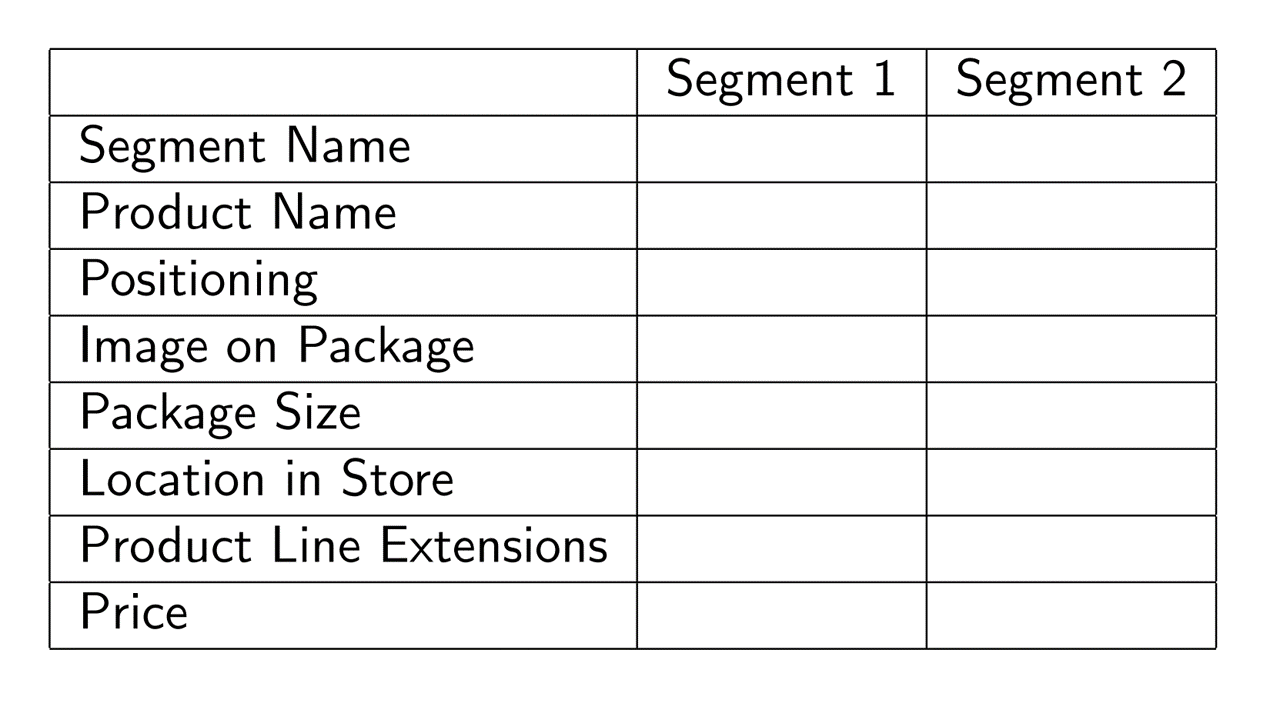

Segmentation Case study: Quidel

- Leading B2B manufacturer of home pregnancy tests

- Tests were quick and reliable

- Wanted to enter the B2C HPT market

- Market research found 2 segments of equal size;

what were they?

Het. Demand Models

Discrete heterogeneity by segment

Continuous heterogeneity by customer attributes

Individual-level demand parameters

- We'll do 1 & 2

MNL Demand

Recall our MNL market share function \(s_{jt}=\frac{e^{x_{jt}\beta-\alpha p_{jt}}}{\sum_{k=1}^{J}{e^{x_{kt}\beta-\alpha p_{kt}}}}\)

What is \(\alpha\)?

What is \(\beta\)?

What limitations does this model have?

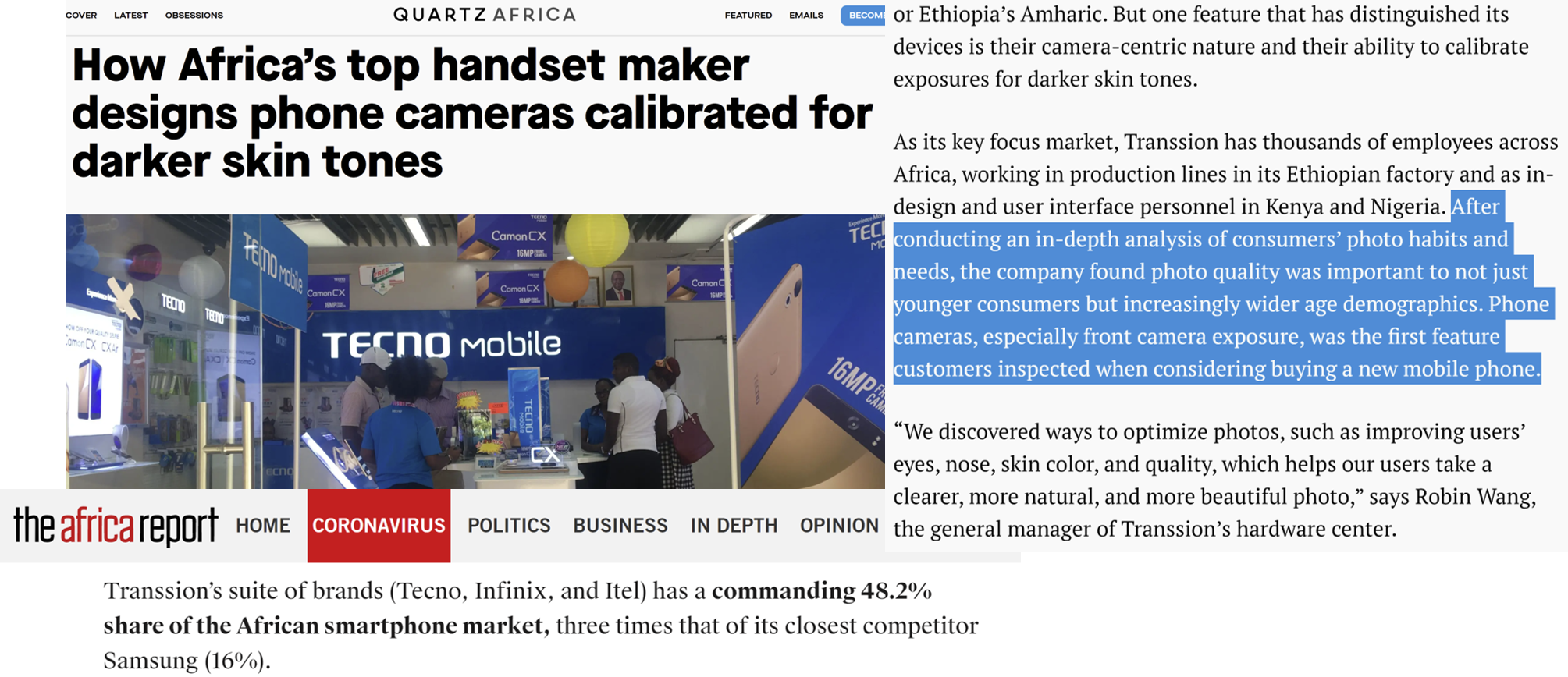

Incorporating customer heterogeneity into demand models can enable a rich array of segment-specific or person-specific customer analytics

Why add het.?

MNL can estimate quality; Het demand estimates quality & fit

Better “policy experiments” for variables we {manage,can measure,predict sales}

- Pricing: price discrimination, two-part tariffs, fees, targeted coupons - Customer relationships: Loyalty bonus, referral bonus, freebies - Social media: Posts, likes, shares, comments, reviews - Advertising: Ad frequency, content, media, channels - Product attributes: Targeted attributes, line extensions, brand extensions - Distribution: Partner selection, intensity/shelfspace, exclusion, in-store environmentPredicts M&A results; oft used in antitrust

1. Discrete heterogeneity by segment

- Assume each customer \(i=1,...,N\) is in exactly 1 of \(l=1,...,L\) segments with sizes \(N_l\) and \(N=\sum_{l=1}^{L}N_l\)

- Assume preferences are homogeneous within segments, and heterogeneous between segments

- Replace \(u_{ijt}=x_{jt}\beta-\alpha p_{jt}+\epsilon_{ijt}\) with \(u_{ijt}=x_{jt}\beta_l-\alpha_l p_{jt}+\epsilon_{ijt}\)

- That implies \(s_{ljt}=\frac{e^{x_{jt}\beta_l-\alpha_l p_{jt}}}{\sum_{k=1}^{J}e^{x_{kt}\beta_l-\alpha_l p_{kt}}}\) and \(s_{jt}=\sum_{l=1}^{L}N_l s_{ljt}\)

- We will do this with predefined segments based on usage

- We can also estimate segment memberships. Pros and cons?

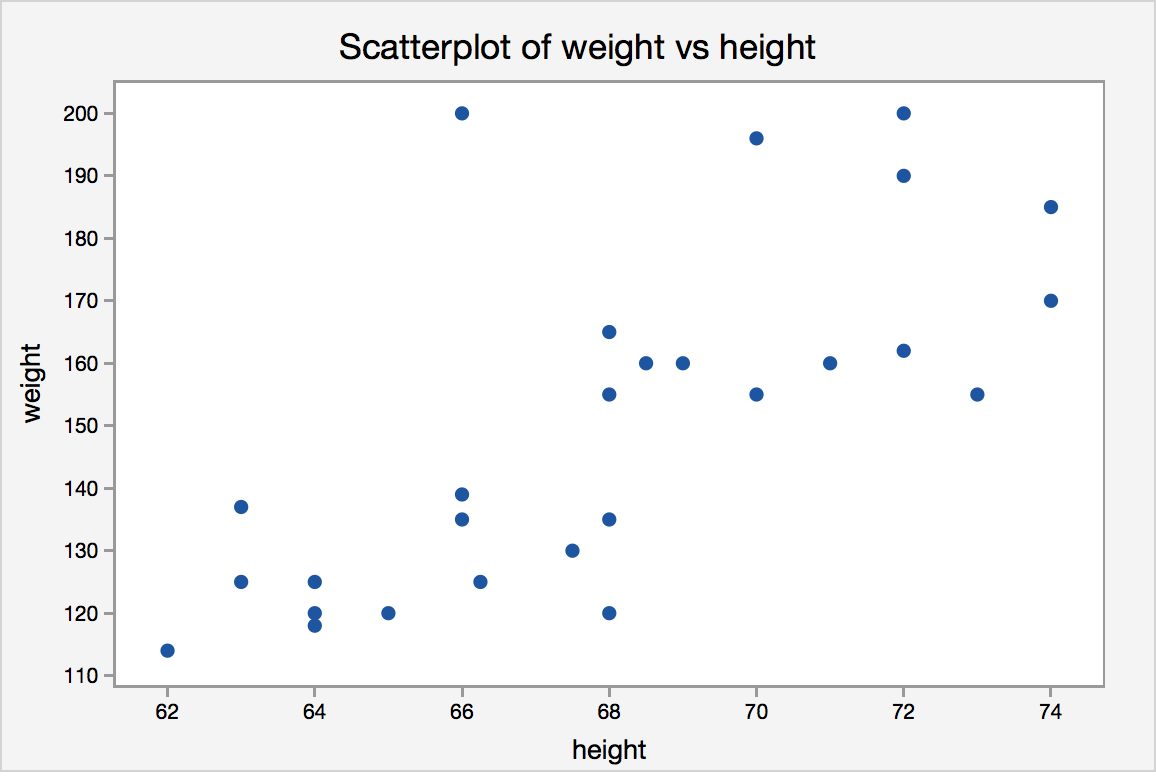

2. Continuous heterogeneity by customer attributes

Let \(w_{it}\sim F(w_{it})\) be observed customer attributes that drive demand, e.g. usage

\(w_{it}\) is often a vector of customer attributes including an intercept

Assume \(\alpha=\gamma w_{it}\) and \(\beta=\delta w_{it}\)

Then \(u_{ijt}=x_{jt}\delta w_{it}- p_{jt}\gamma w_{it} +\epsilon_{ijt}\) and

\[s_{jt}=\int \frac{e^{x_{jt}\delta w_{it}- p_{jt}\gamma w_{it}}}{\sum_{k=1}^{J}e^{x_{jt}\delta w_{it}- p_{jt}\gamma w_{it}}} dF(w_{it}) \approx \frac{1}{N_t}\sum_i \frac{e^{x_{jt}\delta w_{it}- p_{jt}\gamma w_{it}}}{\sum_{k=1}^{J}e^{x_{jt}\delta w_{it}- p_{jt}\gamma w_{it}}}\]

- We usually approximate this integral with a Riemann sumWhat goes into \(w_{it}\)?

What if \(dim(x)\) or \(dim(w)\) is large?

3. Individual demand parameters

Assume \((\alpha_i,\beta_i)\sim F(\Theta)\)

- Includes the Hierarchical Bayesian Logit from weeks 2&3Then \(s_{jt}=\int\frac{e^{x_{jt}\alpha_i-\beta_i p_{jt}}}{\sum_{k=1}^{J}e^{x_{jt}\alpha_i-\beta_i p_{jt}}}dF(\Theta)\)

Typically, we assume \(F(\Theta)\) is multivariate normal, for convenience, and estimate \(\Theta\)

- We usually have to approximate the integral, often use Bayesian techniques (MSBA/PhD)

- Or, we can estimate \(F\) but that is very data intensive

- In theory, we can estimate all \((\alpha_i,\beta_i)\) pairs without \(\sim F(\Theta)\) assumption, but requires numerous observations & sufficient variation for each \(i\)

How to choose?

Humans choose the model

How do you know if you specified the right model?

- Hints: No model is ever "correct." No assumption is ever "true" (why not?)How do you choose among plausible specifications?

Pros and cons of model enrichments or simplifications?

Model specification

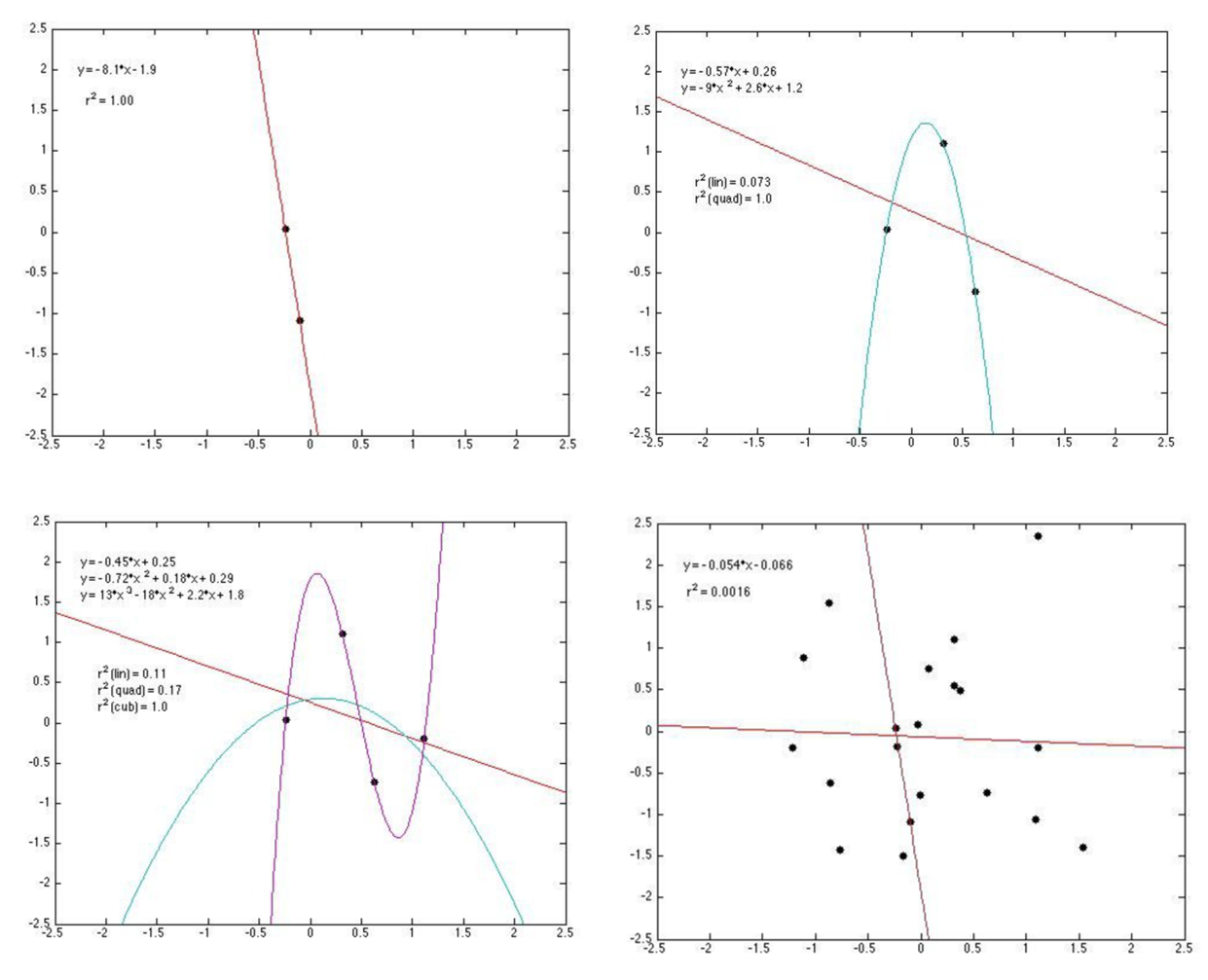

Bias-variance tradeoff

- Adding predictors always increases model fit - Yet parsimony often improves predictionsMany criteria drive model selection

- Modeling objectives - Theoretical properties - Model flexibility - Precedents & prior beliefs - In-sample fit - Prediction quality - Computational properties

How to avoid overfitting?

Retrodiction = “RETROspective preDICTION”

- Knowing what happened enables you to evaluate prediction quality - We can compare different models and different specifications on retrodictionsWe can even train a model to maximize retrodiction quality (“Cross-validation”)

- Most helpful when the model's purpose is prediction - More approaches: Choose intentionally simple models - Penalize the model for uninformative parameters: Lasso, Ridge, Elastic Net, etc.

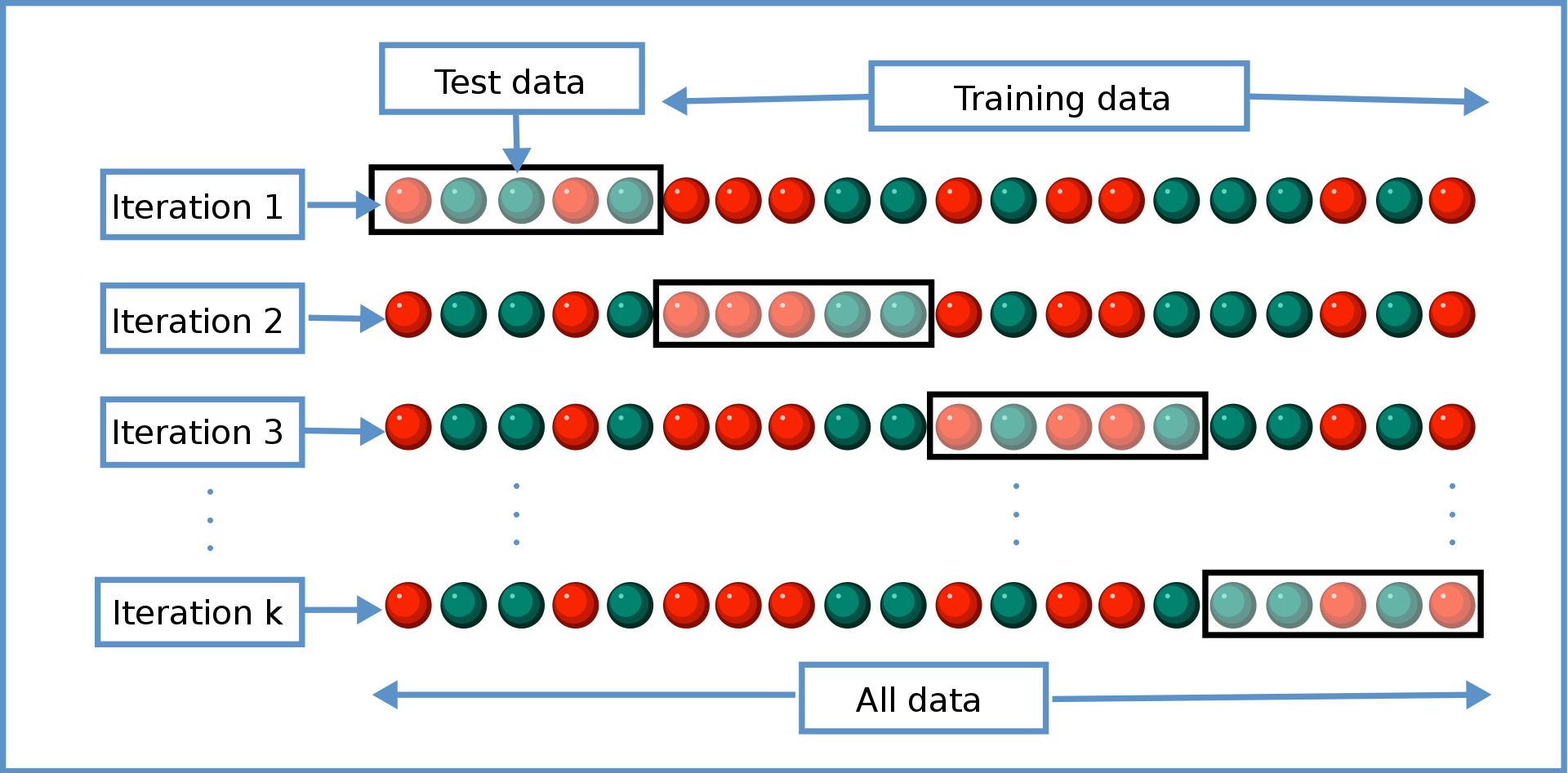

Cross-validation

- Exercise to evaluate retrodiction performance and reduce overfitting risk among a set of candidate models \(m=1,...,M\). Algorithm:

- Randomly divide the data into \(K\) distinct folds

- Hold out fold \(k\), use remaining data to estimate model \(m\), make predictions for fold \(k\); store prediction errors

- Repeat 2 for each \(k\)

- Repeat 2&3 for every model \(m\)

- Retain the model with minimum prediction errors

- You estimate the model K times

- Each estimation uses a different (K-1)/K proportion of the data

- We evaluate retrodiction quality K times, then average them

- When K=N, we call that "leave-one-out" cross-validation

- Important: cross-validation is just one tool in the toolbox

- Final model selection also depends on theory, objectives, other criteriaEx-post evaluations

- Can a model withstand changes in the environment?

- Non-random holdouts are strong tests, but can only be retrospective

Het demand modeling: More considerations

- Customer data needs to be high quality (GIGO, Errors-in-variables biases)

- Implementation needs to consider qualitative factors {effectiveness, legality, morality, privacy, conspicuousness, equity, reactance, costs, speed, understanding}

- Guiding principle (not a rule):

Using data to legally, genuinely serve customers’ interests is usually OK - Using private data against customer interest can harm some consumers, break laws, or incur liability. Litigation can kill a start-up

- Major US laws: COPPA, GLBA, HIPAA, patchwork of state laws

- Guiding principle (not a rule):

- Heterogeneity in a demand model does not resolve price endogeneity

- T/F: Adding random predictors into \(X\) can decrease OLS \(R^2\).

Class script

- Add heterogeneity to MNL model

- Individual-level heterogeneity via price-minutes interaction

- Segment-level heterogeneity via segment-attribute interactions

- Both

Wrapping up

Homework

- Let’s take a look

Recap

Heterogeneous demand models enable personalized and segment-specific policy experiments

Demand models can incorporate discrete, continuous and/or individual-level heterogeneity structures

Heterogeneous models fit better, but will predict worse if overfit

Going further