Marketing+Finance

UCSD MGT 100 Week 10

Let’s reflect

Marketing+Finance

Customer-based corporate valuation

CBCV using credit card expenditure panels

Asset price game

Wrapping up

Hi Finance, I’m Marketing

Finance/marketing crossovers

- Marketing policy effects on stock prices - ROI estimates & budgets (ads, sales, product launch, ...) - Customer opportunity evaluations & financial forecasts - M&A analyses, complementarities & market impacts - Behavioral finance AKA acknowledging that investors are humans and therefore subject to biasesYet disciplinary cultures differ

Current areas of opportunity

Corporate Valuation

Quantitative current valuation of a business

- True valuation, like wtp, is inherently subjective bc future is unknown - Yet we often need to assess value without a full sale, eg investment advice, M&A, settling a lawsuit, IPO pricing, approving a business loanTheoretical best way to measure: sell x% at auction

- But how does valuation changes with x? - Tough experiment to run, but demand usually slopes downCorpVal: Develops, applies models to value businesses

- Inherently stochastic, but ideally closer to appraisal than speculation - Do results depend on who pays? Buyer, seller, 3rd party

Standard CorpVal Formulas

\[Shareholder Value_T=OA_T+NOA_T-ND_T\]

- \(T\) indicates current expectation given Today’s data

- \(OA_T\) is net present value of Operating Assets

- \(NOA_T\) is npv of Non-Operating Assets

- \(ND_T\) is net debt

Discounted Cash Flow (DCF) Model

\[ OA_T=\sum_{t=0}^{\infty}\frac{FCF_{T+t}}{(1+WACC_T)^t} \]

- \(WACC\) is the weighted average cost of capital

- \(FCF\) is Free cash flow, or net operating profit after taxes (NOPAT) minus change in capital expenditures and depreciation and amortization (D&A), minus change in nonfinancial working capital (\(\Delta\)NFWC):

\[ FCF_t=NOPAT_t-(CAPEX_t-D\&A_t)-\Delta NFWC_t \]

Discounted Cash Flow (DCF) Model

\[ NOPAT_t=[Rev_t*(1-AVC_t)-FC_t]*(1-TR_t) \]

- \(Rev\) is revenue

- \(AVC\) is average variable cost

- \(FC\) is fixed cost

- \(TR\) is corporate tax rate

Is this the best way?

Traditionally, analysts predict NOPAT based on past NOPAT:

\[ NOPAT_T = f(\{NOPAT_{T-t}\}_{t=1,...,T}) \]

Can we do better? Enter CBCV

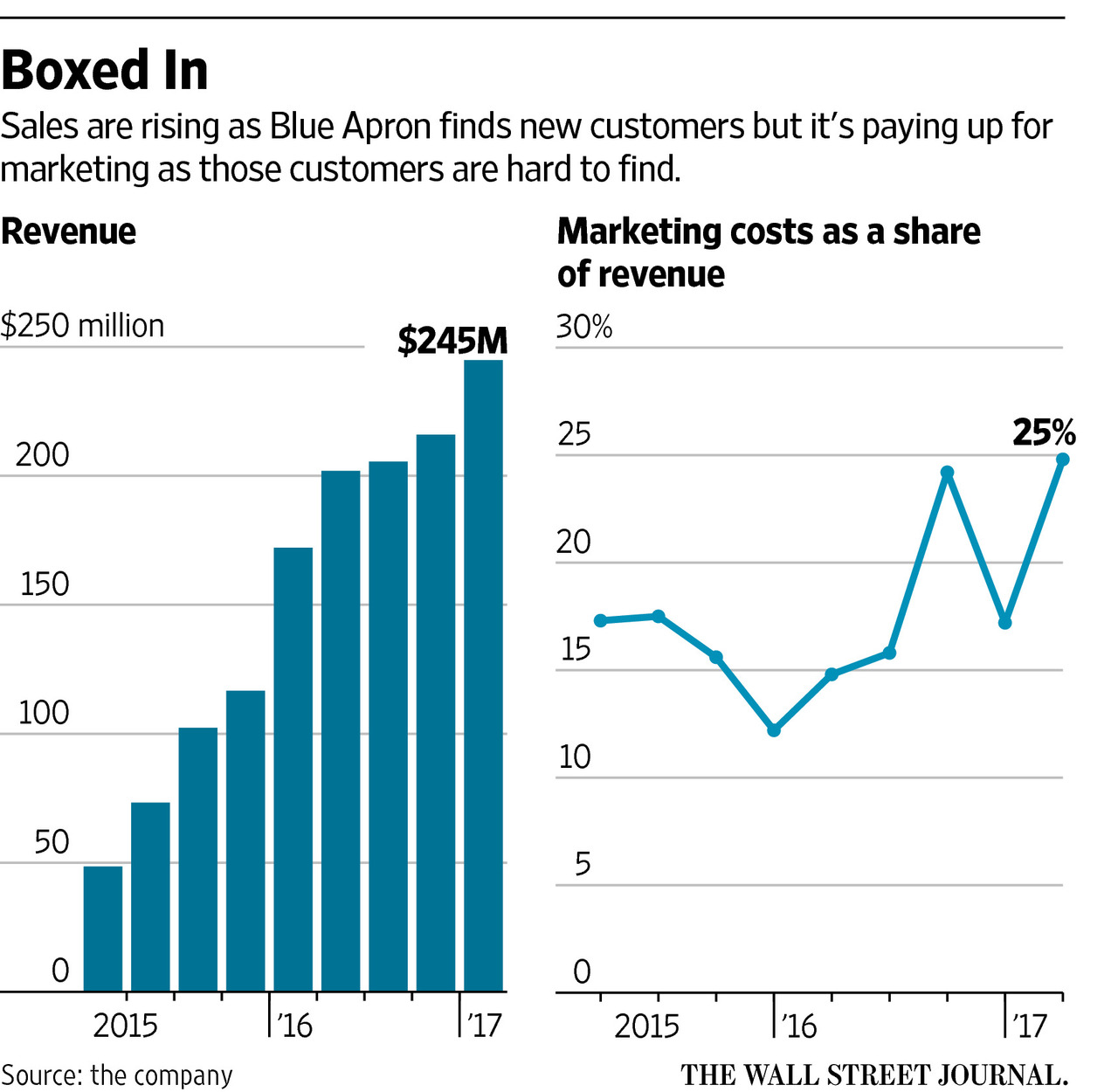

- Start w subscription biz, since rev/cust is roughly constant

Core CBCV Idea

Firm strategies can be described with two attributes:

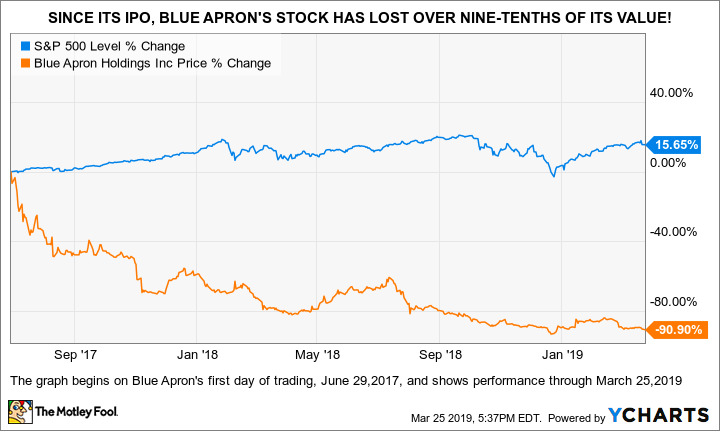

Promote well: High customer acquisition, High CAC, high churn

- Tends to be expensive - Requires a large market to sustain (why?)Retain well: High retention, higher CLV, low CAC

- Tends to be higher $OA_T$, but slower acquisition (why?)

Customer data improve \(NOPAT_t\) forecasts by distinguishing promotion from retention, & better predict future churn

- Intentionally simplified. A biz could both promote & retain well, or neitherHence we should assume

\[ NOPAT_T = f(\{ACQ_{T-t},RET_{T-t}\}_{t=1,...,T}) \]

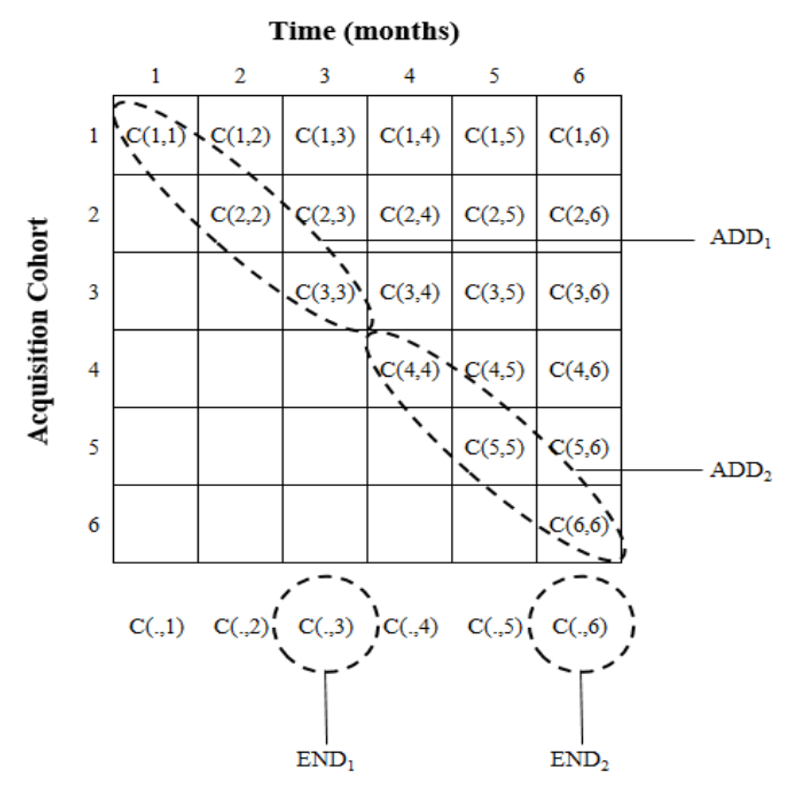

The C(.,.) Matrix

Let \(C(t,t')\) be the number of customers acquired in time \(t\) & still active in time \(t'\ge t\)

Firm can count customers \(C(t,t')\) for all pairs \((t<T,t'<T)\)

- Sophisticated companies monitor these data internally\(C(t,t)\) is simply customers acquired in period \(t\)

\(C(t,t')\) is weakly decreasing in \(t'\)

\(C(.,t)\) is all customers active at time \(t\)

- roughly proportional to $NOPAT_t$\(C(.,t)-C(.,t-1)\) is attrition at time \(t\)

Public firms report profits quarterly. CBCV advocates public reporting of

- customer acquisition by cohort

- customer attrition by cohort

What about transaction businesses?

CBCV extends to non-subscription businesses, but

- Customer attrition not directly observed - Purchase frequency varies across customers & time - Spending varies across customers & time - Cross-selling opportunities and takeup vary across customers & timeGreater variance and model uncertainty,

hence forecasts are more uncertain

Blue Apron in 2017

Blue Apron in 2019

Credit card expenditure panels

Anonymous credit card expenditure data: Report

- Anonymous card ID - Merchant ID - Spend, timestamp, location, merchant categoryData are anonymized, but data fusion enables stochastic reidentification

Powerful implications for CBCV:

- You no longer need internal data to estimate C(t,t') - Investors can mine CC data for customer insights

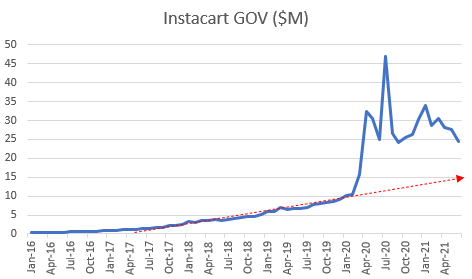

Instacart Gross Order Value

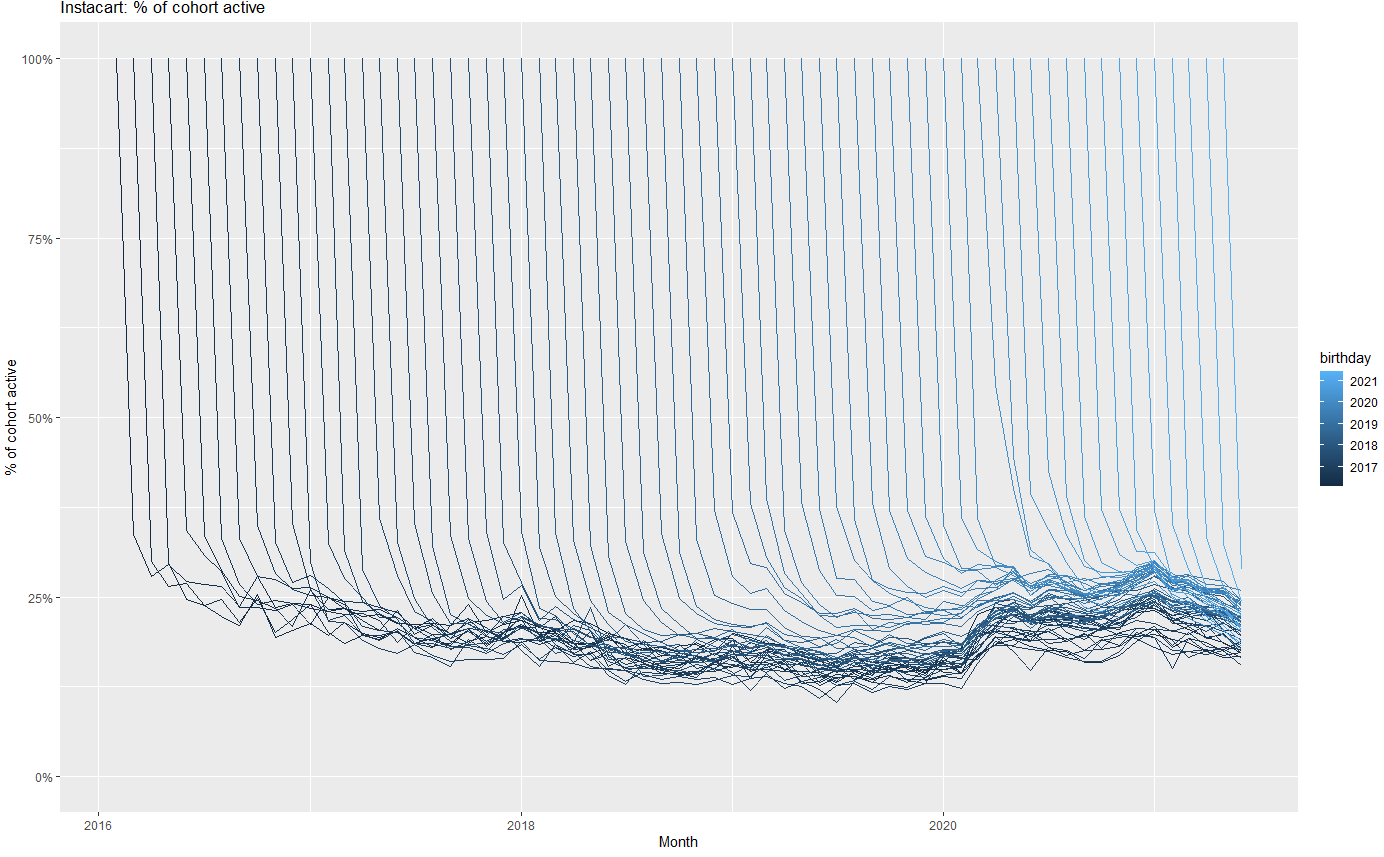

Instacart Retention by Cohort

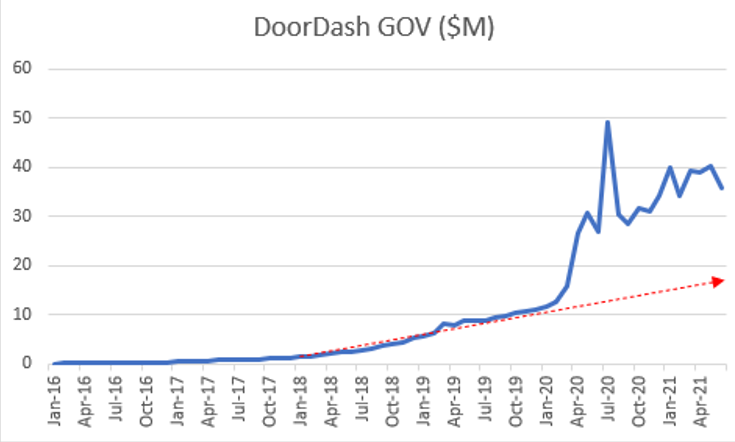

Doordash Gross Order Value

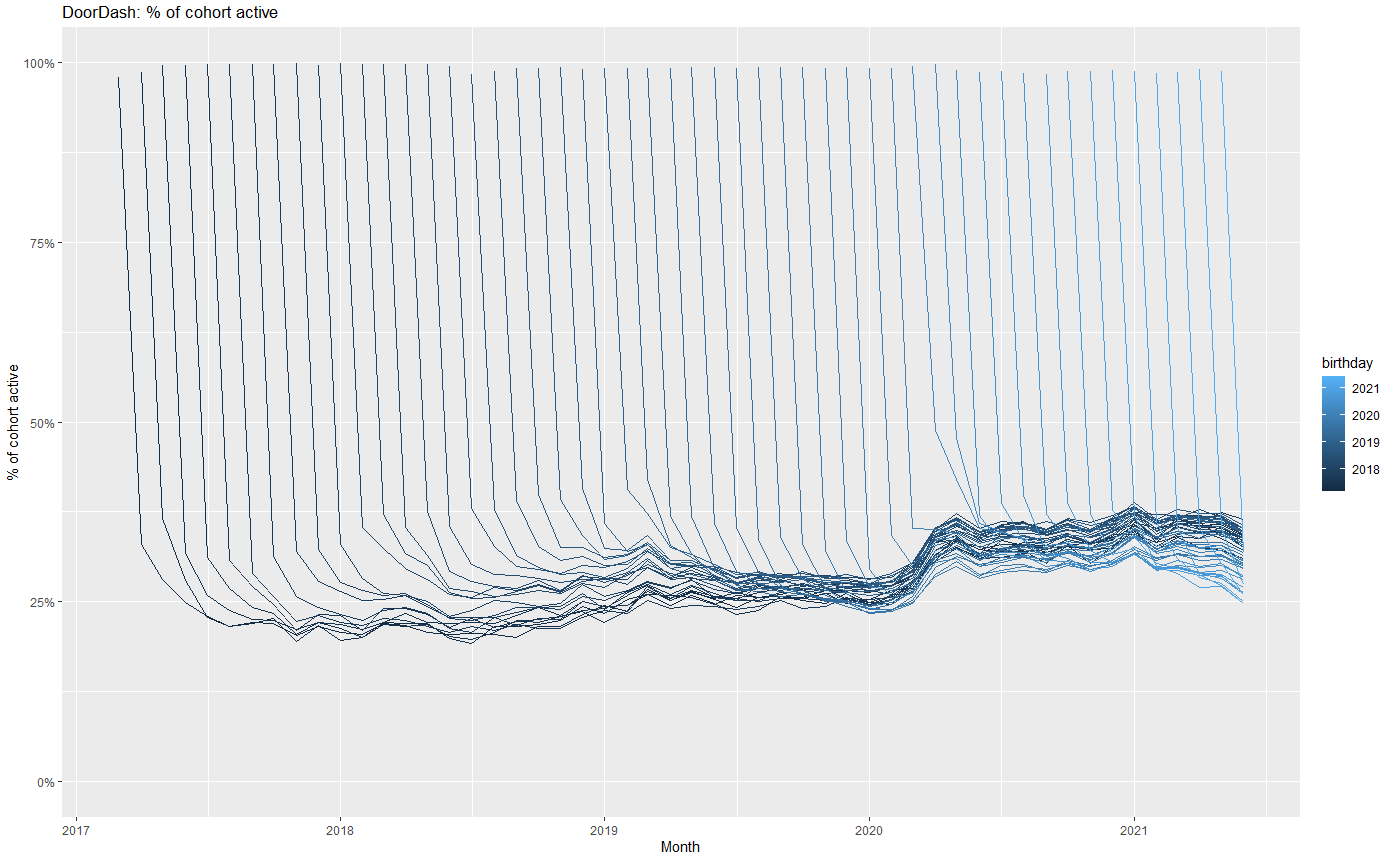

Doordash Retention by Cohort

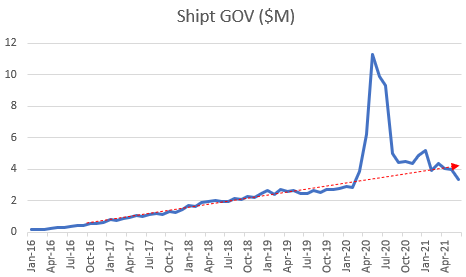

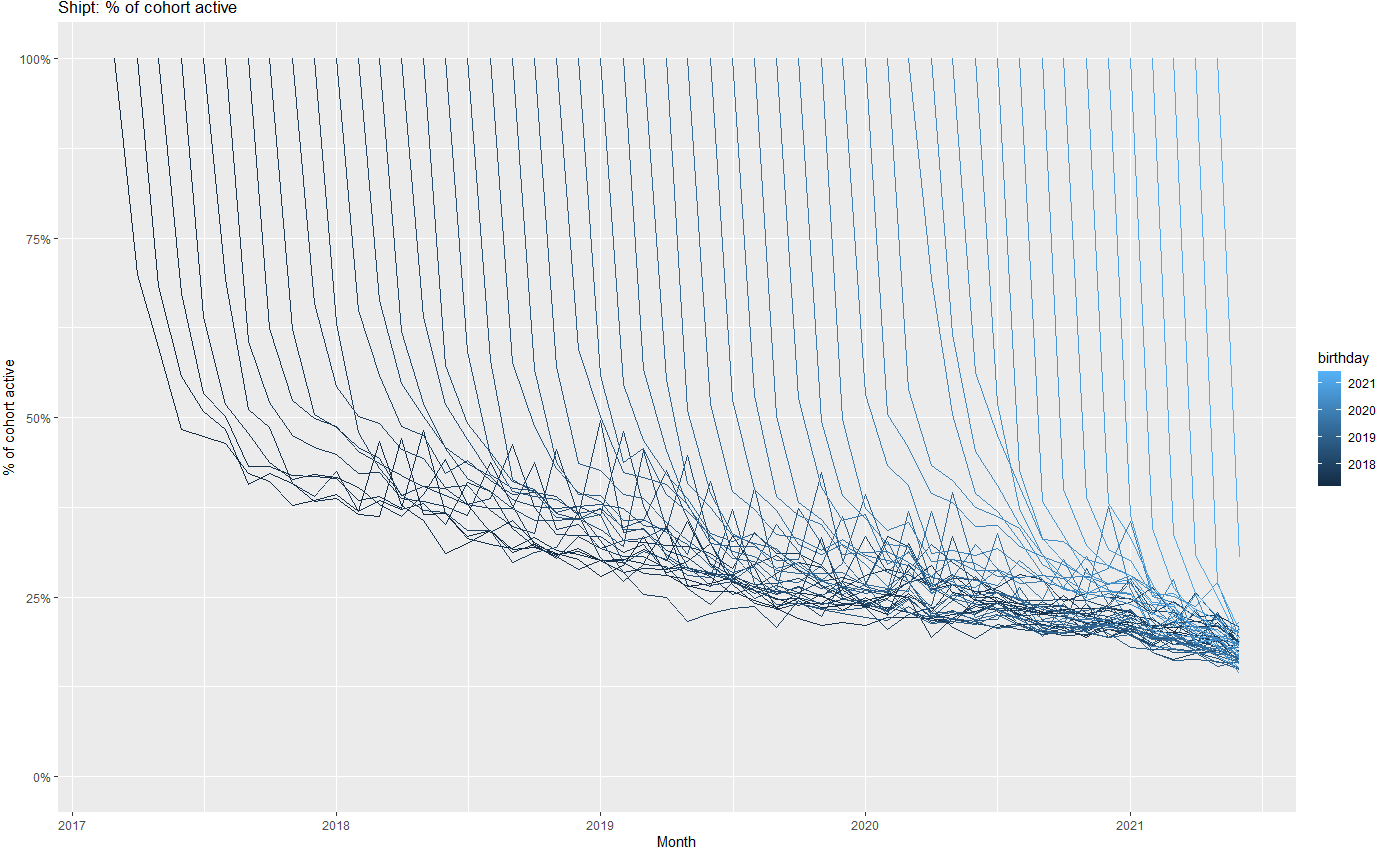

Shipt Gross Order Value

Shipt Retention by Cohort

CBCV rollout

CBCV is slowly entering finance & accounting canon

- Firms increasingly experiment with reporting customer metrics (ThetaCLV) - Firms with high retention self-select into reporting it - Numerous firms have customer-level data available for reportingPrediction: A tipping point

- Should incentivize start-ups toward customer retention - Should make capital allocation more efficient - But, won't happen until enough investors demand it

Asset Price Game

You are VCs trading start-up shares (“assets”)

Each team starts with 3 assets and $20 cash

Teams can make money in 1 of 3 ways:

- Collect dividends

- Buy and sell assets

- Asset payouts at the end of the game

Richest team at the end gets extra credit

Play in teams of 5 : Form now & appoint a speaker

Trading rounds

- We will play \(n\) 2-minute rounds. Within each round :

- Trade assets/money in double Walrasian auction

- After trading, each asset pays its owning team $1 dividend

- After dividend, each asset goes bankrupt with 1/6 probability

After \(n\)th round, every surviving asset pays an extra $6

Trading

4 allowable trading statements:

- State a selling price: “Team (w) ASKS $a.bc”

- State a buying offer: “Team (x) BIDS $d.ef”

- Accept a selling price: “Team (y) ACCEPTS Team (w)’s ask”

- Accept a buying offer: “Team (z) ACCEPTS Team (x)’s bid”

Rules:

No more than 1 ASK or BID per team per round

No ASK more than the lowest open ask (why?)

No BID less than the highest open bid

You can only ask/bid/accept if you have the asset or cash to cover

We track all trades; you track your own assets, payouts and cash by round

- Copy this google sheet; let’s walk through it

Raise your hand to ask/bid/accept

Any questions?

Let’s play!

What happened?

Why did that happen?

What strategy did your team use?

How might this connect to real financial markets?

Wrapping up

Modeling: 1000’ view

Model: Simple representation of complicated phenomena

- We can't fully understand the phenomena - We can fully understand the model, but even this can be hardModeling is a superpower!

- You can understand, explain and predict things that others can't - Modeling skills develop with practice & transfer across domainsCautions

- Simple models are often 85-95% effective - There is never a true model: "Model uncertainty" is always present - Never mistake the model for the phenomena - It's "a" model, not "your" model - All models assume; good models assume transparently - If it were true, we wouldn't call it an "assumption" - Anyone can tear down a model; improving a model is work

Homework

No assignment or quiz

Chat briefly about the final

Congrats you did it!

Special congratulations for those who are graduating

- It's a big deal. We're proud of you.

Recap

- Corporate valuation uses past profits to predict future profits, without using granular customer metrics

- Customer-Based Corporate Valuation (CBCV) advocates reporting \(C(t,t')\) to enable investors to better predict profits

- CBCV is still small but growing, there are opportunities here

- Fundamentals help calculate asset prices

- No customers, no business

Going further

What are the most important statistical ideas of the past 50 years?

Customer-Based Corporate Valuation for Publicly Traded Noncontractual Firms

Decomposing Firm Value by Belo et al. (2021) for a competing perspective