Demand Modeling

UCSD MGT 100 Week 3

Demand Curves

- Theory

- Challenges

- What firms do

Inverse Demand Curve

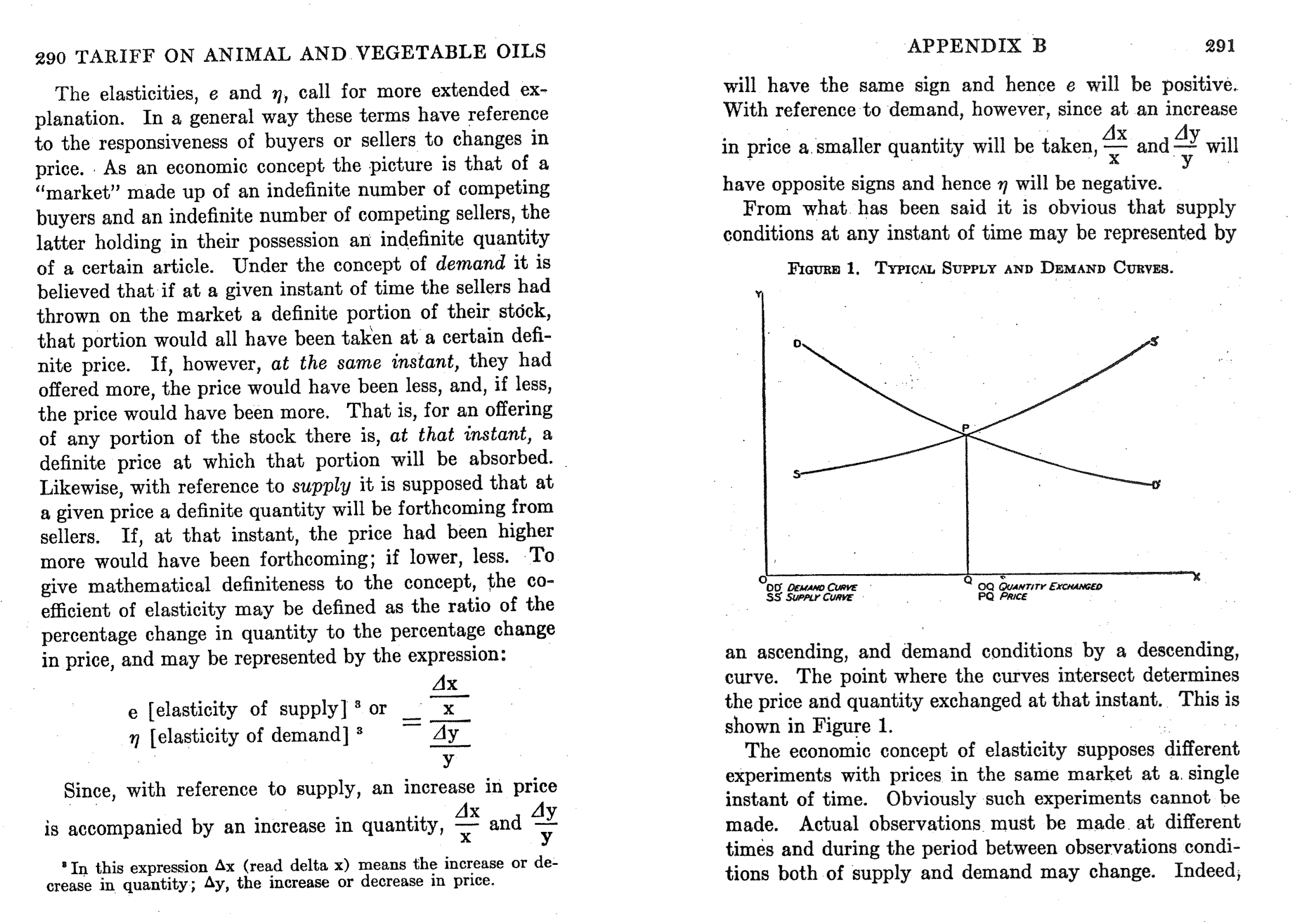

Demand Curves: Theory

Useful theoretical concept that summarizes market response to price

- Why is it useful?Often taught with perfect competition

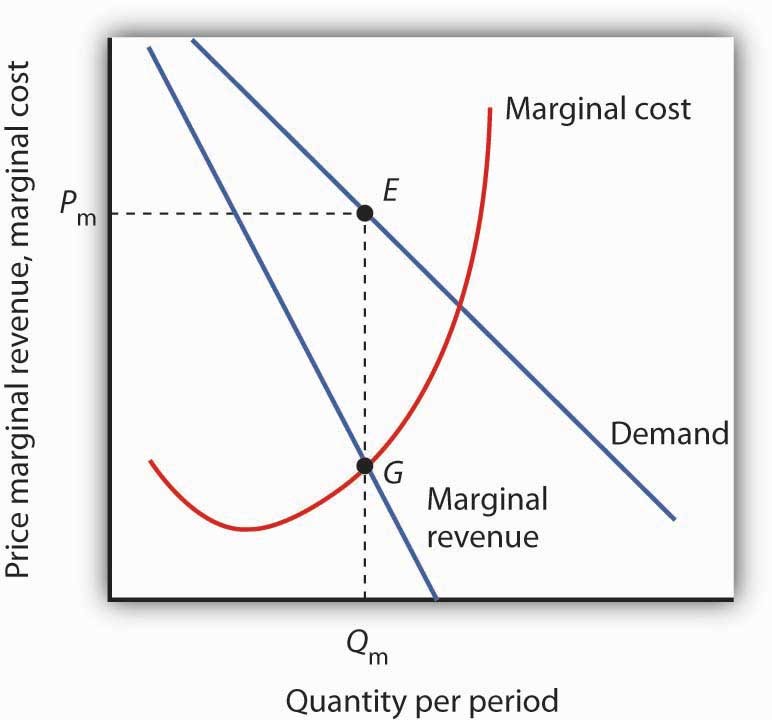

- Typically assumes stable, competitive, frictionless markets w free entry, full information, no differentiation - Model predicts zero LR economic profits - Any evidence?Also, taught with monopoly i.e. market power

- What is market power? How would we measure it?

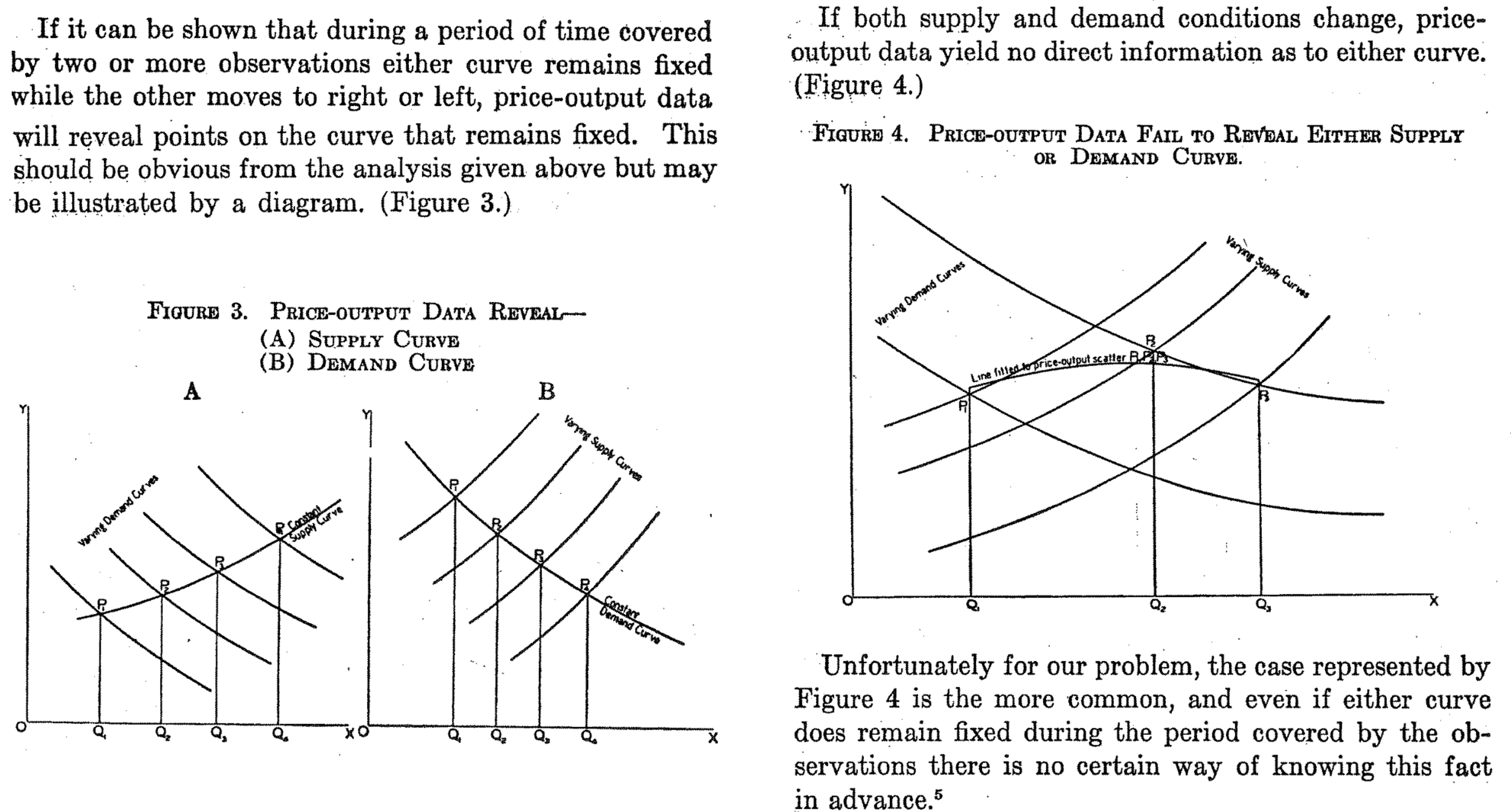

Demand Curves: Challenges

Idealized demand curves are hard to estimate (why?)

Where do product attributes come in?

- What if we don't observe all attributes? "Price endogeneity"Many things can predict demand

- preferences, information, advertising, quality, match value, quality, complements, substitutes, competitor prices, entry, taxes and other policies, retail distribution, nature of equilibrium, stockpiling, consumer income, ...What do we need to estimate Demand?

- Observable, exogenous variation in costs or price - Otherwise, "price endogeneity" will bias demand estimates

How firms learn demand

Market research

- Conjoint analysis, customer interviews, simulated purchase environmentsExpert judgments, e.g. salesforce input

Cost-driven price adjustments

- Often one-sidedDemand modeling with archival data

Price experiments

- Market tests, digital experiments, bandits, digital couponsBest practice: triangulation

Price Experiments

Ideally, the best way to learn demand, because you create exogenous price variation; but…

Competitors & consumers can observe price variation

May change purchase timing, stockpiling or

reference pricesCompetitors, distribution partners or suppliers may react

Hence, experimenting to learn demand may change future demand

Demand Modeling: Pros

Relatively inexpensive for large organizations

Fully compatible with price experiments

- Either/or framing would be a false dichotomy: "Yes-and"Confidential, fast

Depends on real consumer choices, i.e. revealed preferences

- As opposed to stated preferencesEnables demand predictions at counterfactual prices

Enables predictions of competitor pricing response

Prediction accuracy: evaluable after price changes

Demand Modeling: Cons

Requires data, exogenous price variation, time, effort, training, commitment, trust, organizational buy-in

Always subject to untestable modeling assumptions

Requires the near future to resemble the recent past

- To be fair, all predictive analytic techniques require these 3

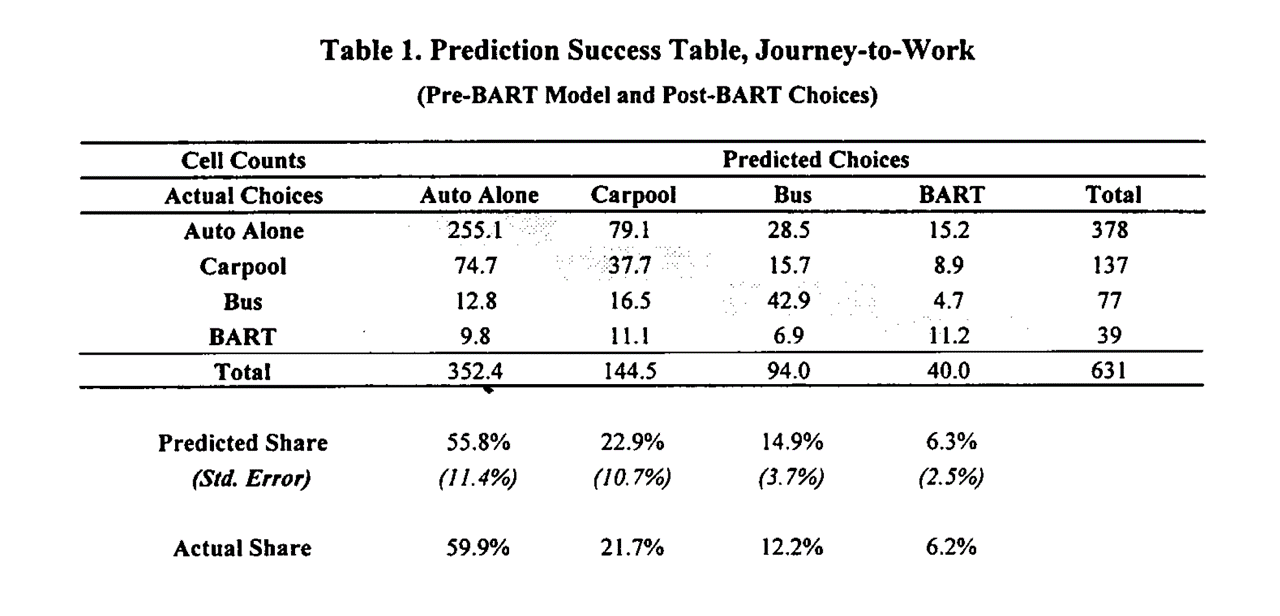

Do Demand Models Work?

Evidence is supportive, but not thick

- Informally, I know several people who maintain demand models in large orgs - Formal evidence requires researchers and firm to collaboratively (a) estimate demand, (b) act on demand estimates, (c) observe how actions affect outcomes, & (d) report the results publicly. Hard to do & incentives conflict - Demand modeling can also go badly, e.g. due to price endogeneityMisra & Nair (2011) : B2B sales & salesforce compensation

Nair et al. (2017) : Casino loyalty rewards

Pathak and Shi (2021) : School choice

Dube and Misra (2023) : ZipRecruiter ad pricing

Ko et al. (2024) : E-Commerce apparel promotions

Multinomial Logit

- history, math, properties, discussion

Multinomial Logit (MNL)

- Time tested, famous, popular demand model

- Ported to econ from stats & psych by McFadden (1974, 1978, 1981; “Logistic regression’’)

Multinomial Logit (MNL)

Let \(i\) index consumers, \(j=1,...,J\) products, and \(t\) index choice occasions

Assume each \(i\) gets indirect utility \(u_{ijt}\) from product \(j\) in market \(t\):

\[u_{ijt}=x_{jt}\beta-\alpha p_{jt}+\epsilon_{ijt}\]

- Then, assuming each \(i\) picks the \(j\) that maximizes \(u_{ijt}\), has unit demand, and that \(\epsilon_{ijt}\sim\)i.i.d.\(EV_1(0,1)\), market share is

\[Prob.\{u_{ijt}>u_{ikt}\forall{k\ne j}\}\equiv s_{jt}=\frac{e^{x_{jt}\beta-\alpha p_{jt}}}{\sum_{k=1}^J e^{x_{kt}\beta-\alpha p_{kt}}}\]

With \(N_t\) consumers, \(q_{jt}(\vec{x}; \vec{p})=N_t s_{jt}\). See Train 2009 sec 3.10 for proof

- Estimating \(\alpha\) and \(\beta\) enables us to predict every product’s quantity response to a change in any product’s attributes \(x_{jt}\) or price \(p_{jt}\)

MNL: Common factors

- Suppose \(\gamma_{t}\) indicates how popular the category is in market \(t\), so utility is \(u_{ijt}=\gamma_{t}+x_{jt}\beta-\alpha p_{jt}+\epsilon_{ijt}\). Then market share becomes

\[s_{jt}=\frac{e^{\gamma_{t}+x_{jt}\beta-\alpha p_{jt}}}{\sum_{k=1}^J e^{\gamma_{t}+x_{kt}\beta-\alpha p_{kt}}}\]

\[s_{jt}=\frac{e^{\gamma_{t}} e^{x_{jt}\beta-\alpha p_{jt}}}{e^{\gamma_{t}}\sum_{k=1}^J e^{x_{kt}\beta-\alpha p_{kt}}}\]

\[s_{jt}=\frac{e^{x_{jt}\beta-\alpha p_{jt}}}{\sum_{k=1}^J e^{x_{kt}\beta-\alpha p_{kt}}}\]

- Similar exercise applies to individual-specific intercepts \(\gamma_i\), or individual-time interactions \(\gamma_{it}\). Only differences across products affect predicted market shares

MNL: Share differences

- We set product \(j=1\) utility to \(u_{i1t}=\epsilon_{i1t}\) to normalize utility, i.e.

\[s_{1t}=\frac{1}{\sum_{k=1}^J e^{x_{kt}\beta-\alpha p_{kt}}}\]

- Hence for every \(j\ne 1\), consider an affine transformation of market shares:

\[ln(s_{jt})-ln(s_{1t})=x_{jt}\beta-\alpha p_{jt}\]

- Looks like a regression equation… we sometimes add an error \(\xi_{jt}\) to represent unobserved product attributes:

\[ln(s_{jt})-ln(s_{1t})=x_{jt}\beta-\alpha p_{jt}+\xi_{jt}\]

- We use the \((J-1)T\) differences in market shares to estimate demand parameters

MNL Estimation

Define \(y_{ijt} \equiv 1\{i \text{ chose } j \text{ in } t\}\). I.e., \(y_{ijt}=1\) iff \(i\) choose \(j\) at \(t\); otherwise \(y_{ijt}=0\).

- Maximum likelihood: Assume the probability of observation \(\{i,j,t\}\) is \(s_{jt}^{y_{ijt}}\);

then lik. is \(L(\beta )=\prod\limits_{\forall i,j,t} s_{jt}^{y_{ijt}}\); & choose parameters to maximize log lik:

\[\sum_{\forall i,j,t} y_{ijt}\ln s_{jt}\]

- Method of Moments: Choose \(\alpha\) and \(\beta\) to solve some vector of “moments,” i.e. interactions between exogenous observables \(z\) and error terms, e.g.

\[ \sum_{\forall j,t}z_{jt} (\frac{\sum_{\forall i}y_{ijt}}{N_t} - s_{jt})=0\]

- Linearize the model, choose parameters to minimize the sum of square errors

MNL Goodness-of-fit Statistics

Discrete choice models predict choice probabilities rather than choices, because utility is always unobserved; hence nonstandard fit statistics

Predicted outcomes are inherently stochastic, so limited predictive ability

- Likelihood Ratio Test: (not R-sq)

\[\rho=1-\frac{ln L(\hat\beta)}{ln L(0)}\]

As \(L(\hat\beta)\to 1\), \(ln L(\hat\beta)\to 0\), \(\rho\to 1\)

As \(ln L(\hat\beta)\to ln L(0)\), \(\rho\to 0\)

- Heuristic: 0.2-0.4 is pretty good

Hit Rate: % of individuals for whom most-probable choice was actually chosen

R-sq using prediction errors at the \(jt\) level

MNL Pros

Microfounded, i.e. behavioral predictions are consistent with a clearly specified theory of consumer choice

- Theory is utility maximization - Economists widely believe that microfounded models are more generalizable than purely statistical models*Extensible to accommodate preference heterogeneity

- We'll cover 3 types of extensions in heterogeneous demand modelingLikelihood function is globally concave in the parameters, ensuring fast and reliable estimation

- Remember our local vs. global optimum discussion?

MNL Cons

Assuming \(\epsilon_{ijt}\sim\)i.i.d.\(EV_1(0,1)\) is convenient but unrealistic

- More likely, more similar products would experience more similar demand shocks - Alternatives exist but can be computationally expensiveAnalyst selects the choice set \(j=1,...,J\), market size \(N_t\), attributes \(x_{jt}\), and price structure \(p_{jt}\).

- What's a j? What's a t? What's in x? How do we measure p? Who's in N? - "Tuning factors" or "Analyst degrees of freedom"Market share derivatives depend on market shares alone (IIA; see Train Sec. 3.6)

Price Endogeneity

- Affects all demand models, not just MNL

IIA: Deeper dive

- Famous example from McFadden (1974)

- Suppose you estimate demand for transportation with three options: {Blue Bus, Red Bus, Car}, each with 33% market share

- Now suppose you painted the red buses blue and want to predict market shares in the new choice set: {Blue Bus, Car}

- MNL will predict Blue Bus and Car shares of 50%, not 67% and 33% (why?)

IIA: Remedies

IIA is testable & usually rejected by data

Common remedies:

Extend the model to impose structure on choice set,

e.g. Nested Logit or Ordered LogitChange \(\epsilon_{ijt}\sim\)i.i.d.\(EV_1(0,1)\), e.g. Multivariate Probit with correlated errors

Change model structure so IIA property does not obtain, e.g. heterogeneous logit

Price endogeneity:

35 INSANE explanations

- #4 will SHOCK you. Like, comment, subscribe

- Covered on the exam…ask lots of questions

2. Fundamental issue

Demand model is a causal price-quantity relationship

Yet observed prices may correlate with other demand and supply determinants

Exogenous price variation req’d to distinguish correlation from causation (“identification”)- Price endogeneity is a "data problem" not a "model problem" - Can be hard to verify empirically--needed data is missing--but widely believed important - Implies wrong demand slope, biased demand predictionsSign of bias depends on unobserved correlation

- If corr(price,unobs)<0 --> estimated demand is "too flat" or too elastic - If corr(price,unobs)>0 --> "too steep" or too inelastic - Affects all demand models, not just MNL

3. E-Commerce Example

Imagine an unobserved demand shock, such as a viral Instagram post, increases Amazon product awareness and sales

Sales spike, inventory drops, automated pricing system increases price to monetize remaining inventory

What do data show? Corr(sales, price) > 0 !!

- Common enough to be unsurprising when this happens

4. An Analogy

Foot size data significantly predict reading comprehension among children!

- In fact, age causes both foot size - And age causes reading comprehension - Without age, you cannot accurately estimate the causal relationship between foot size and reading comprehension. You can only measure the correlation

- Also, crib purchases significantly predict childbirth!

5. Sports example

You have data on Lakers ticket prices and sales before and after the Luka trade

Prices and sales are both higher after the trade

Does this mean that higher price caused higher sales?

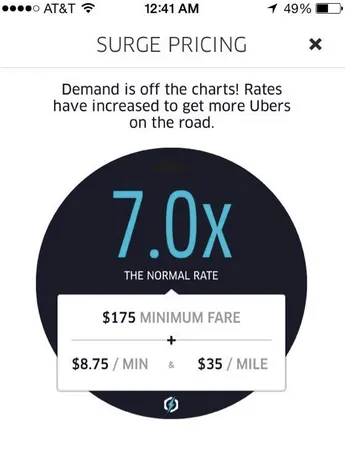

6. Example: Digital systems

Uber surge pricing:

Positive Demand shocks increase price

Negative Supply shocks increase priceSystem adjusts the price without knowing the causes

Many digital inventory-based pricing systems are similar

7. Shrinkflation

Shrink the package, maintain the price

Also, "Skimpflation" : reduce ingredient intensity8. Multiple determinants

- Price causes quantity demanded; but so do other things

9. Oft-unobserved price correlates

Changes in consumer preferences, income, market size

Retail distribution, prominence, stocking

Digital marketing, including search ads, display ads, affiliates, influencers, coupons

Competitor prices, preference shocks, retail, dig mktg

Any may correlate with equilibrium prices, leading to endogeneity biases if left uncontrolled

10. General model interpretation

Posit a model \(q=f(x,p,e)\) for \(p=\)price, \(q=\)quantity,

\(e=\)error reflecting all relevant unobservables; estimate \(\frac{dq}{dp}\)What does \(\frac{dq}{dp}\) mean exactly? 2 possibilities:

1. Correlation: Empirical tendency of q to change with p, holding other observable attributes x constant 2. Causality: Causal effect of 1-unit change of p on q 1 is descriptive analytics; 2 is diagnostic analyticsStandard econometric assumptions only admit #2 when \(corr(p,e)==0\) (“exogenous”)

Hence, what the estimates can teach us depends on what we cannot see This is a tricky situation: When can we trust our demand model? Answer 1: When we have exogenous price variation, hence corr(p,e)==0; OR Answer 2: When we observe all demand drivers; but this is difficult to verify

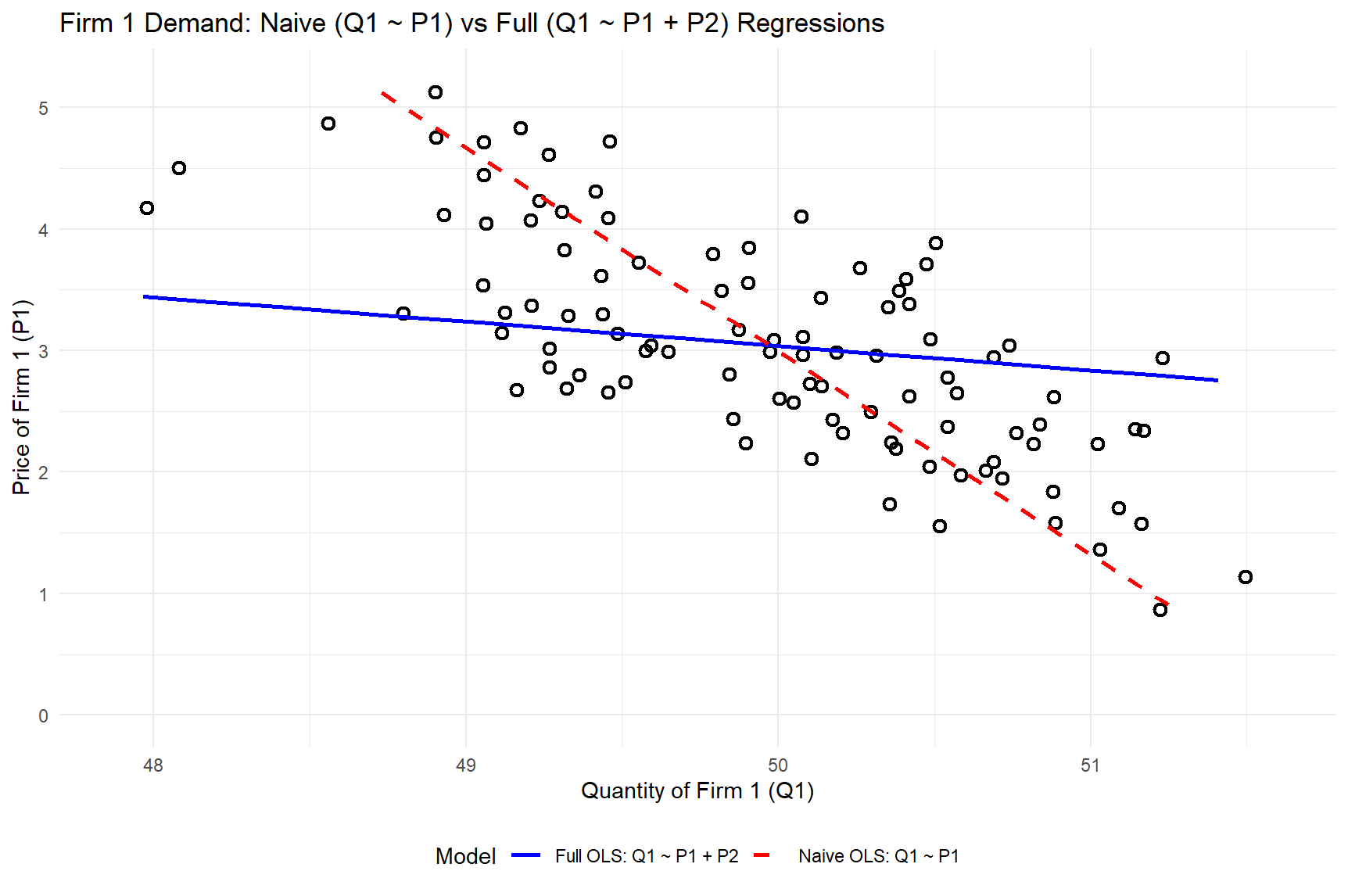

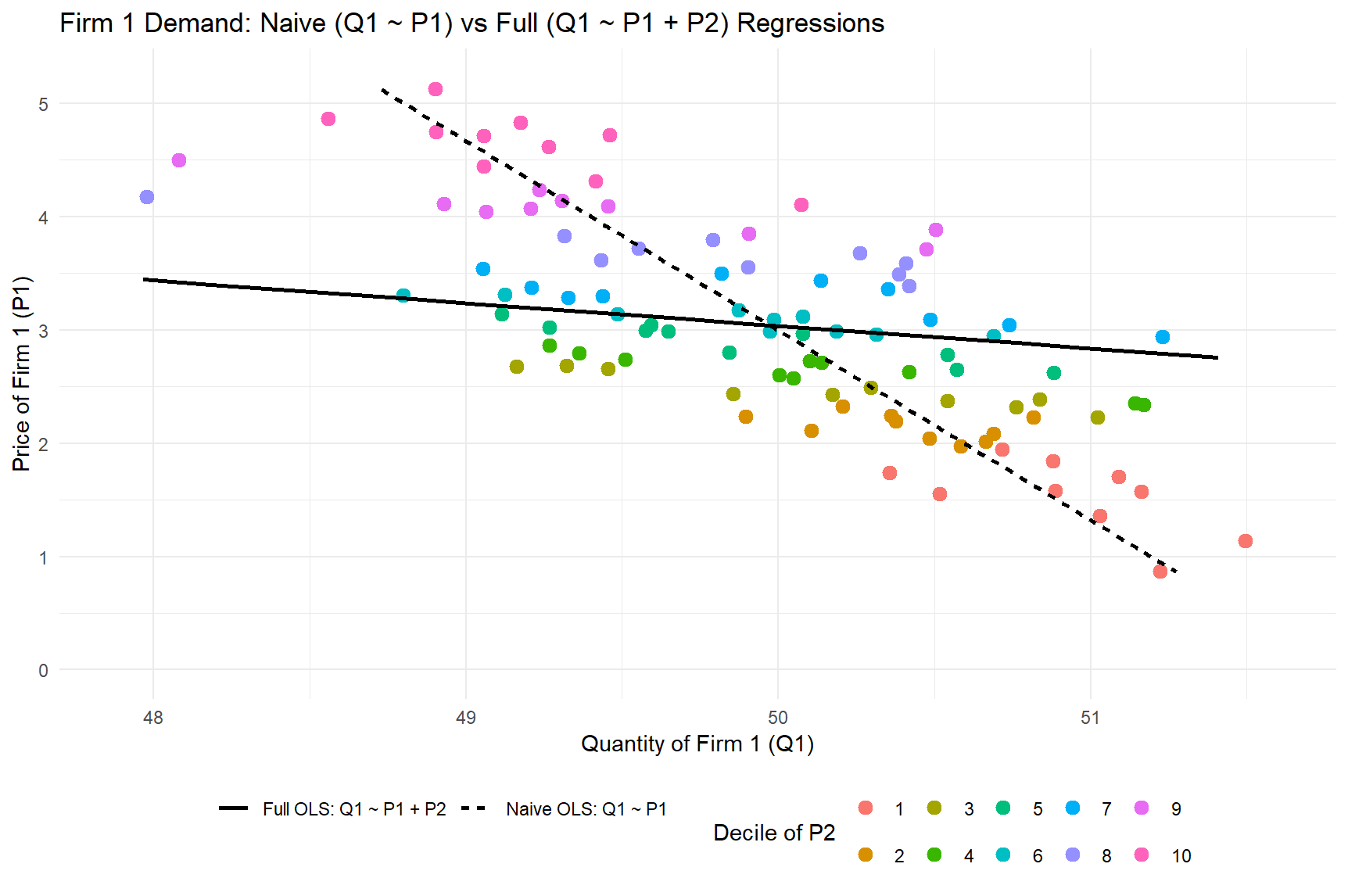

11a. Simulation

Suppose 2 firms, correlated cost shocks and correlated prices, MNL demand

Suppose true demand is \(q_1=f(p_1, p_2, \epsilon_1, \epsilon_2)\)

Suppose we use OLS to estimate \(q_1=\alpha + p_1\beta + \epsilon\)

We mistakenly believe that \(corr(p,\epsilon)==0\)

Incorrect: corr(p_1,p_2)>0, and p2 omitted, hence p2 is in epsilon\(\hat{\beta}\) is biased to fit the model’s assumption that \(\sum p_1\epsilon=0\)

Wrong \(\hat{\beta}\) means wrong demand curve slope

…implies wrong demand predictions in response to price

…recommended price will be wrong, may reduce profit

11b. Simulated data generating process

# 1. Simulation parameters and correlated cost shocks

set.seed(14) # for reproducibility

n_periods <- 100 # number of periods

market_size <- 100 # total market size (e.g. number of customers)

rho <- 0.9 # influence of costshock1 on costshock2

# Demand model parameters

alpha <- 0.2 # price sensitivity (common across products)

intercept1 <- 9 # baseline utility for product 1

intercept2 <- 9 # baseline utility for product 2

# (Outside option utility is normalized to 0)

# Simulate cost shocks for the two firms (correlated)

shock1 <- rnorm(n_periods)

shock2 <- rho * shock1 + (1 - rho) * rnorm(n_periods)

# Derive prices from costs (higher cost shock -> higher price)

base_cost <- 1

price1 <- 3 * base_cost + shock1

price2 <- 3 * base_cost + shock2

cor(price1, price2)

# 2. Compute market shares and quantities using multinomial logit demand

data <- tibble(

period = 1:n_periods,

shock1 = shock1,

shock2 = shock2,

price1 = price1,

price2 = price2

) %>%

mutate(

# Indirect utilities for each product and outside option:

U1 = intercept1 - alpha * price1,

U2 = intercept2 - alpha * price2,

U0 = 0, # outside option utility (baseline 0)

# Convert utilities to choice probabilities (logit formula):

expU1 = exp(U1),

expU2 = exp(U2),

expU0 = exp(U0),

share1 = expU1 / (expU1 + expU2 + expU0),

share2 = expU2 / (expU1 + expU2 + expU0),

Q1 = market_size * share1,

Q2 = market_size * share2,

Q0 = market_size * (1 - share1 - share2)

)

# Create decile variable for Firm 2's price

data <- data %>%

mutate(p2_decile = ntile(price2, 10))

# 3. OLS regressions for Firm 1's demand

model_naive <- lm(Q1 ~ price1, data = data)

summary(model_naive)

model_full <- lm(Q1 ~ price1 + price2, data = data)

summary(model_full)> # 3. OLS regressions for Firm 1's demand

> model_naive <- lm(Q1 ~ price1, data = data)

> summary(model_naive)

Call:

lm(formula = Q1 ~ price1, data = data)

Residuals:

Min 1Q Median 3Q Max

-1.31867 -0.34908 -0.00637 0.32919 1.19378

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 51.78942 0.17660 293.26 <2e-16 ***

price1 -0.59737 0.05565 -10.73 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.5011 on 98 degrees of freedom

Multiple R-squared: 0.5404, Adjusted R-squared: 0.5357

F-statistic: 115.2 on 1 and 98 DF, p-value: < 2.2e-16

> model_full <- lm(Q1 ~ price1 + price2, data = data)

> summary(model_full)

Call:

lm(formula = Q1 ~ price1 + price2, data = data)

Residuals:

Min 1Q Median 3Q Max

-4.177e-04 -6.103e-05 7.340e-06 7.187e-05 7.270e-04

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 5.000e+01 7.456e-05 670528 <2e-16 ***

price1 -4.999e+00 1.321e-04 -37832 <2e-16 ***

price2 4.998e+00 1.489e-04 33571 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.0001478 on 97 degrees of freedom

Multiple R-squared: 1, Adjusted R-squared: 1

F-statistic: 1.226e+09 on 2 and 97 DF, p-value: < 2.2e-16

Common solutions

Experiments

Randomizing price eliminates confounding with unobservables Gold standard, but has drawbacks mentioned earlierQuasi-experiments using archival data

1. Instrumental variables 2. Regression discontinuities 3. Natural experiments 4. Difference-in-differences 5. Synthetic controls 6. Double/debiased machine learning These approaches are beyond the scope of this classModel the price-setting process

But without exogenous price variation, this is difficult to evaluateBest practice: Triangulate

Exogenous smartphone price variation

Smartphone discounts are randomly assigned,

thus we have exogenous price variation to identify \(\beta\)- This class focuses on how we can use demand models - Endogeneity remedies: Future metrics classes or graduate study - Treat the topic as a demand modeling risk to be understood

Describe price endogeneity in your own words

Generate a novel example related to price and demand Explain how to resolve it

Class script

- Wrangle data

- Estimate MNL

- Interpret parameters and SEs

- Assess model fit

Wrapping up

Recap

- Demand modeling enables data-driven sales predictions for counterfactual prices and attributes, facilitating profit maximization

- MNL is popular bc it is powerful, microfounded and tractable

- MNL has limitations (eg, IIA), but is extesnible by modeling heterogeneity

- Price endogeneity is a data problem that biases demand parameter estimates when price is correlated with unobserved supply or demand shifters. Usually resolved with exogenous price variation

Going further