Branding

UCSD MGT 100 Week 7

Branding

- Logos

- Netflix & Kraft case studies

- What is a brand?

- How do brands influence choice?

- Brand vs. Performance advertising

- Ads measurement

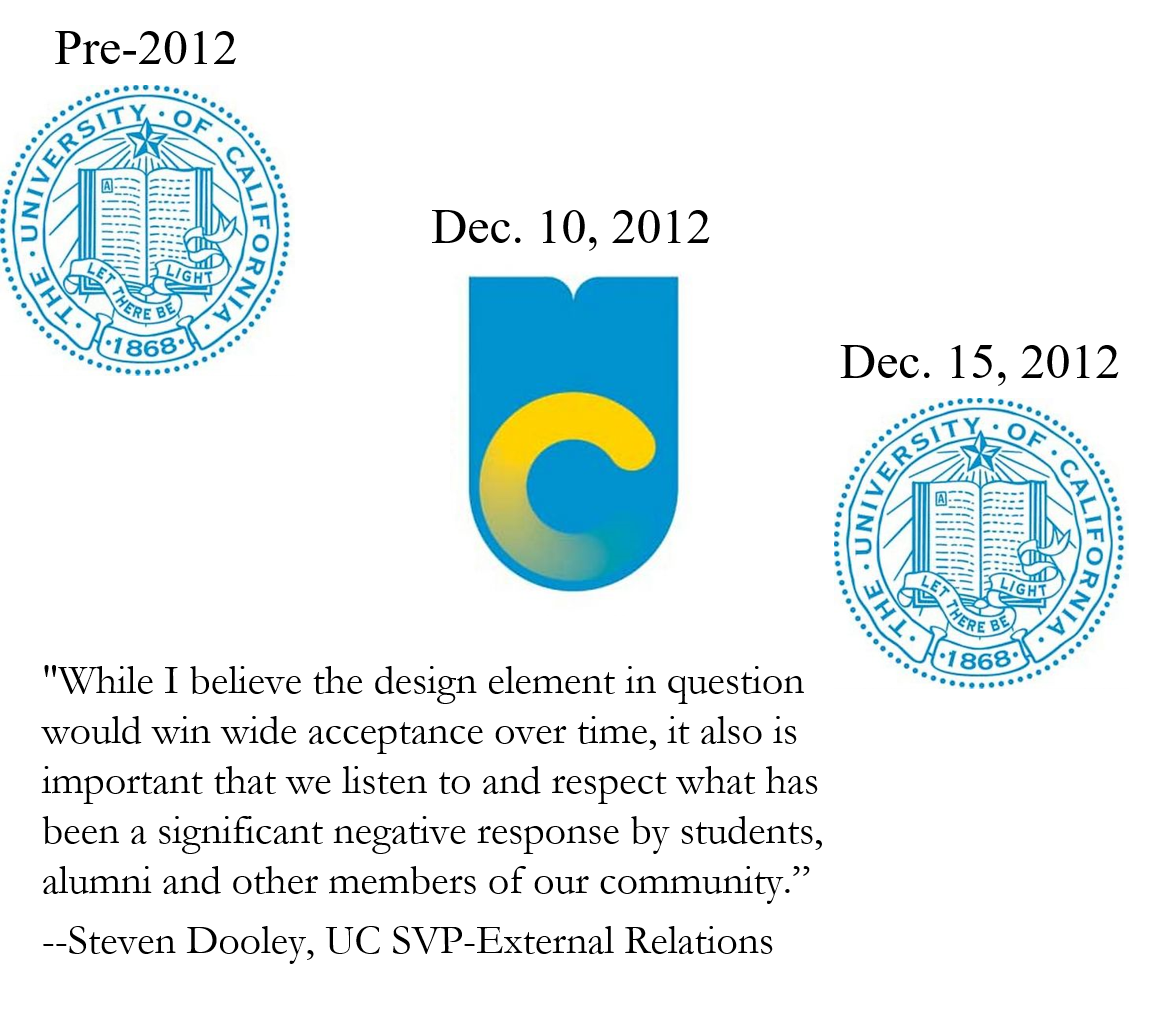

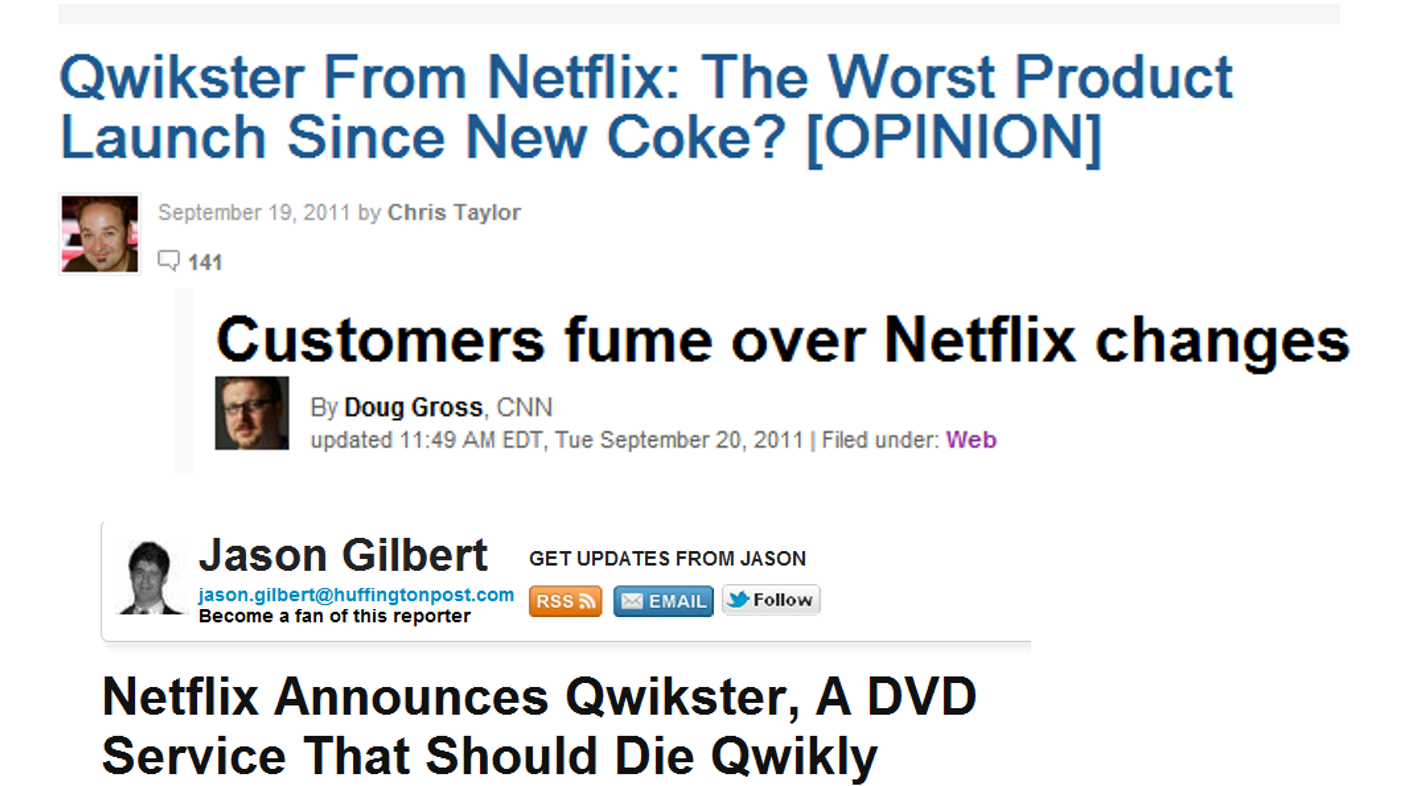

Case study : Netflix

- 1997: Founded to deliver moves over the internet

- 1999: Pioneered DVD-by-mail

- 2007: Launched streaming

- 2011: July price hike, Sept service split into

- Netflix: Video streaming

- “Qwikster”: Rebranded DVD-by-mail service

![]()

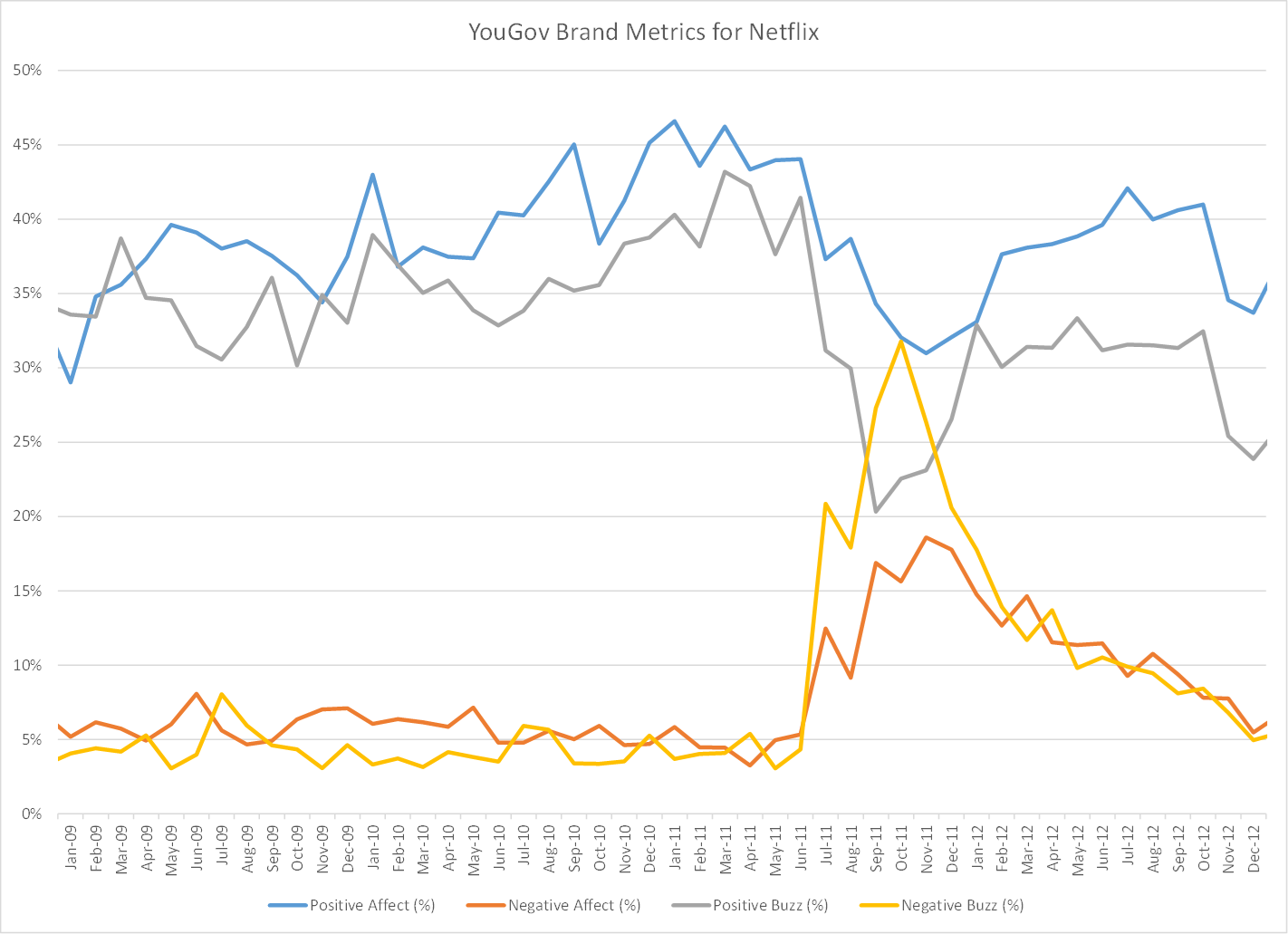

Netflix Case study : Takeaways

- Brand adjustments require consumer acceptance

- You own the IP, not the mental real estate

- Smaller steps encounter less resistance

- Great brands monitor customer perceptions

- If you mis-step, change course

- Some news is bad news

Case study : Kraft Mac n Cheese

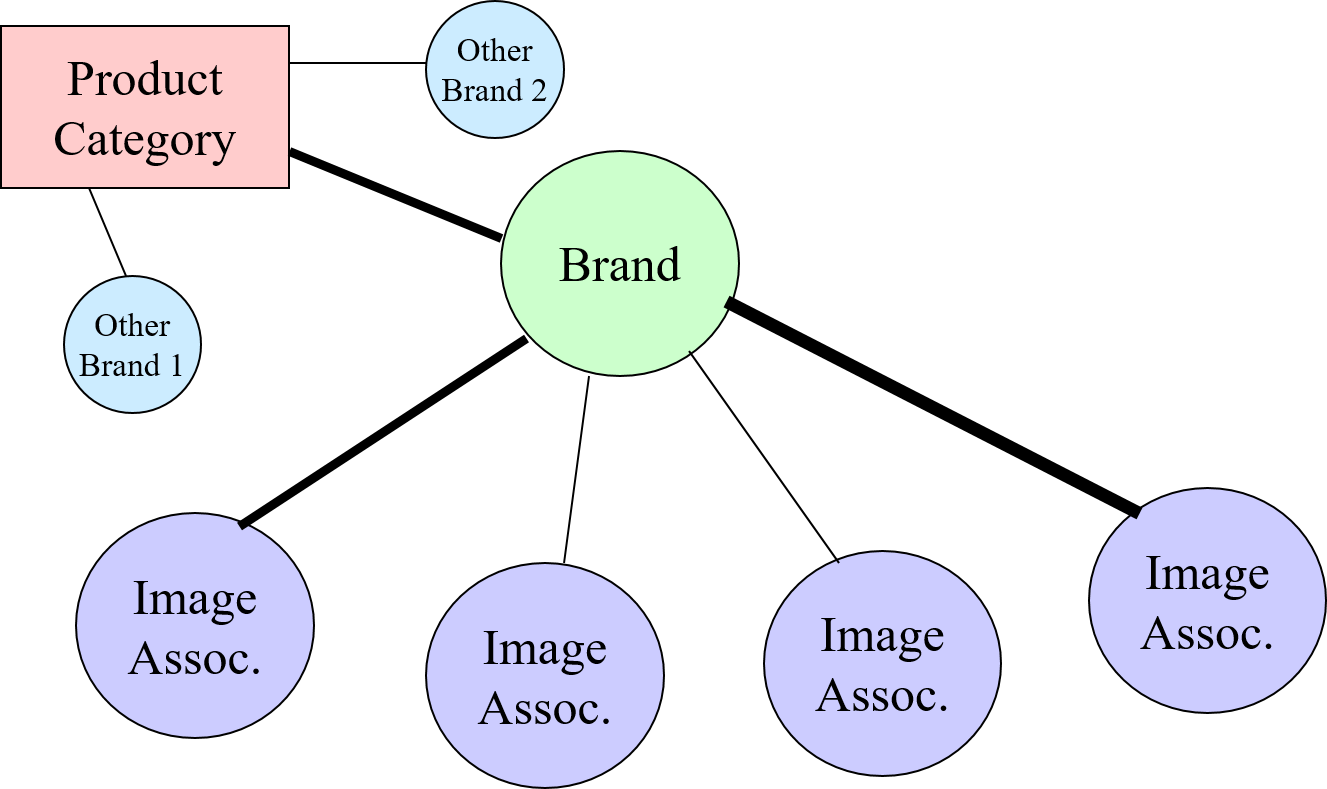

What is a brand?

What is a brand?

An idea that shifts preference

Brands reside in consumers’ minds

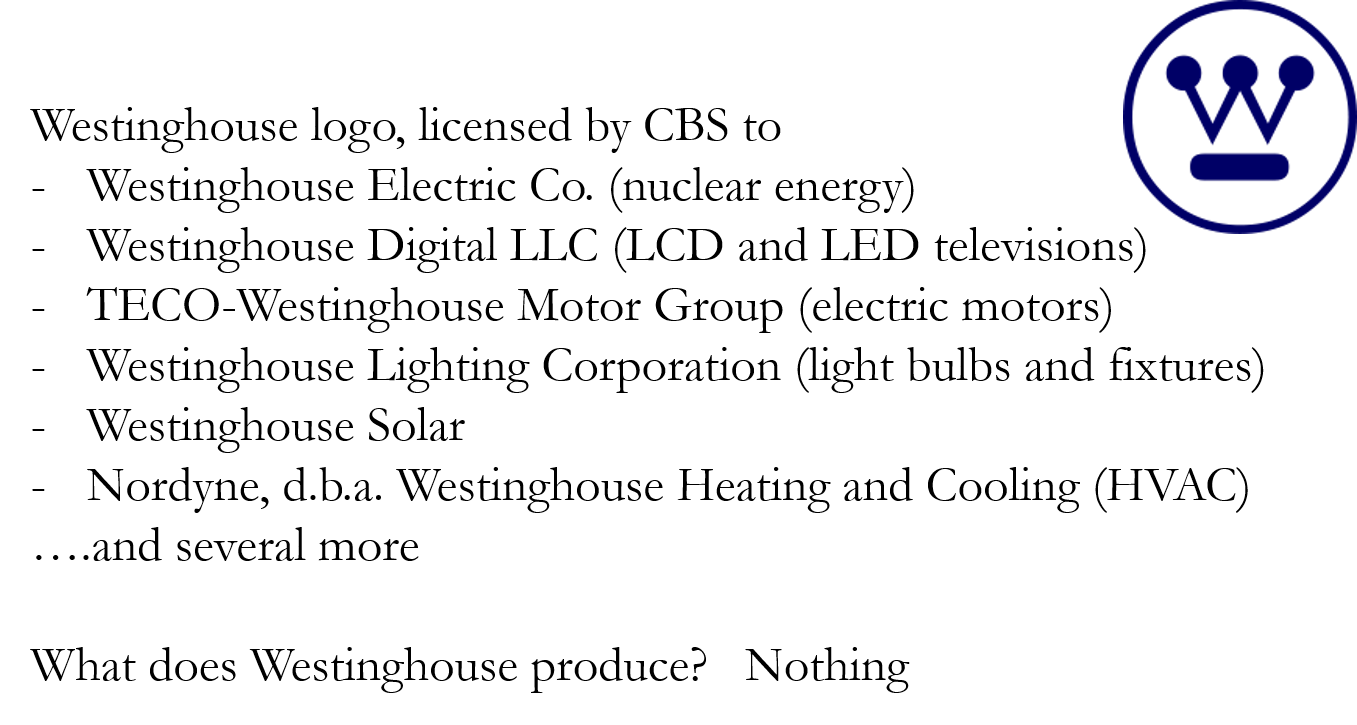

- Mental real estate: Firm owns trademark but not brand

- Rooted in reality but reflects consumer experiences, perceptions and idiosyncracies

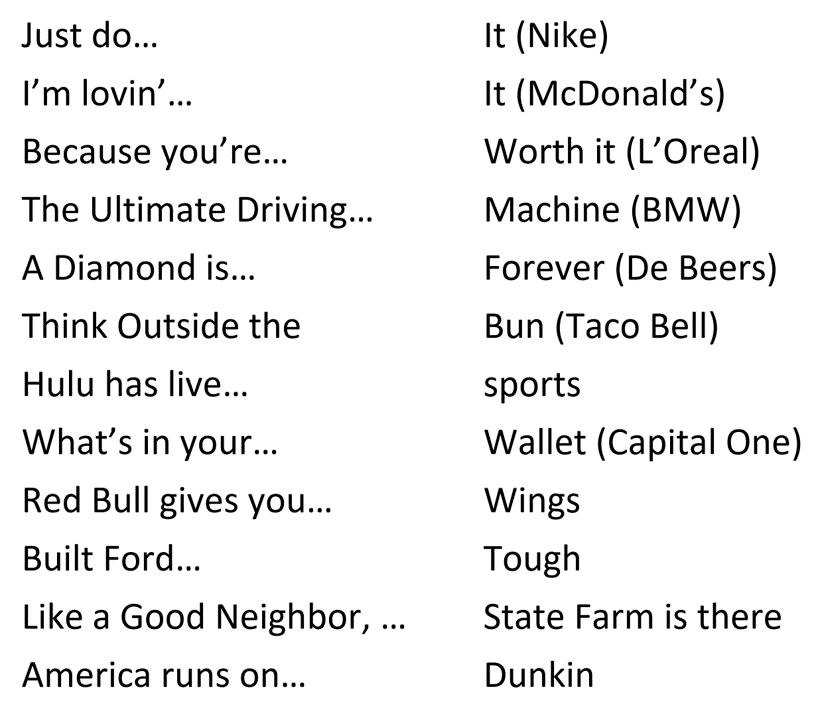

Some auto-associative sequences

- Why do firms spend so much to create these associations in consumers’ minds?

What association?

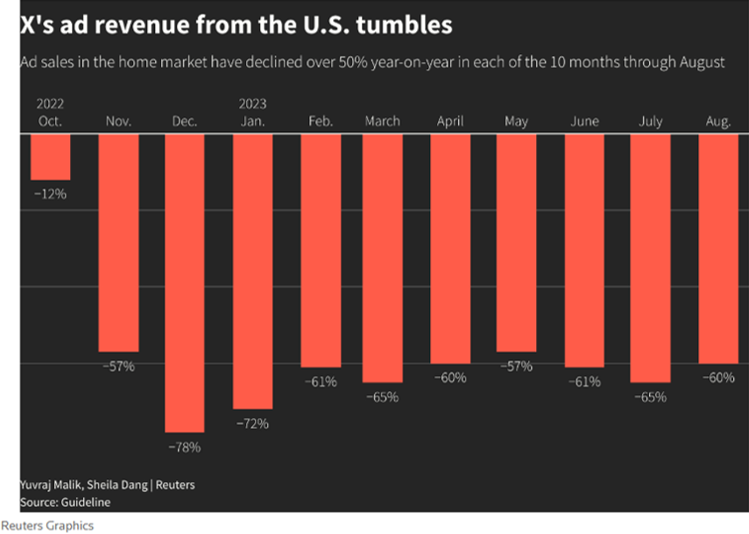

Brand Safety, Content Moderation

- Brands try to avoid unsavory associations–misinfo, hate, violence, obscenity, etc–as they may upset consumers, generate embarrassing publicity, and create unfavorable brand associations

- Brands have long demanded advertising platforms maintain “brand safety”

How do Brands Work?

Credibility

Rapid communication

Personality & Self-expression

Gestalt

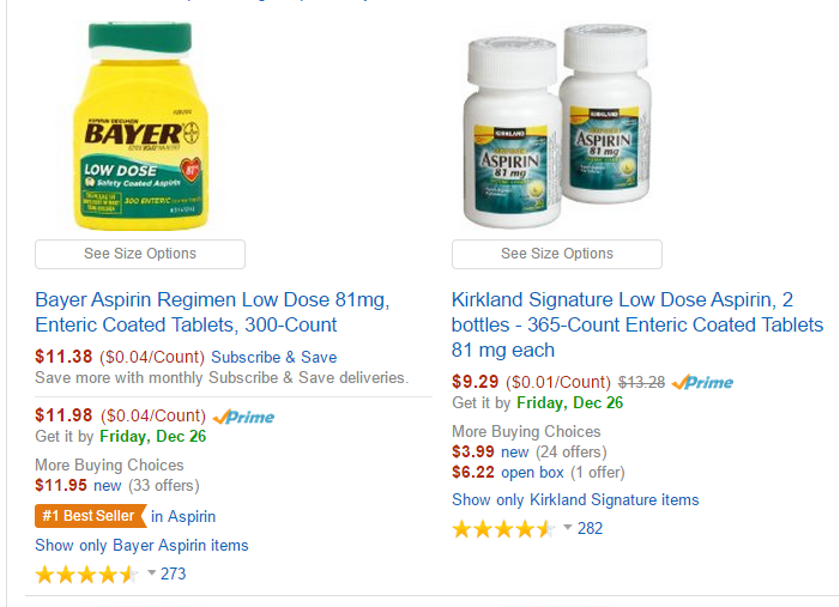

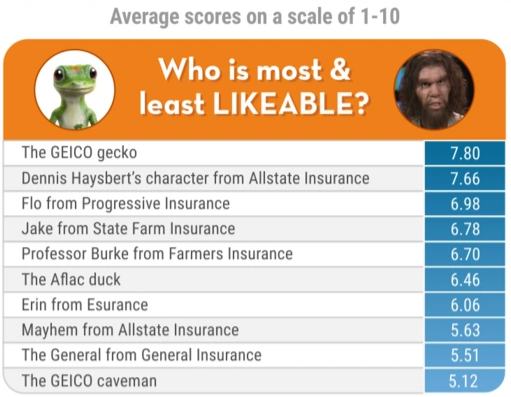

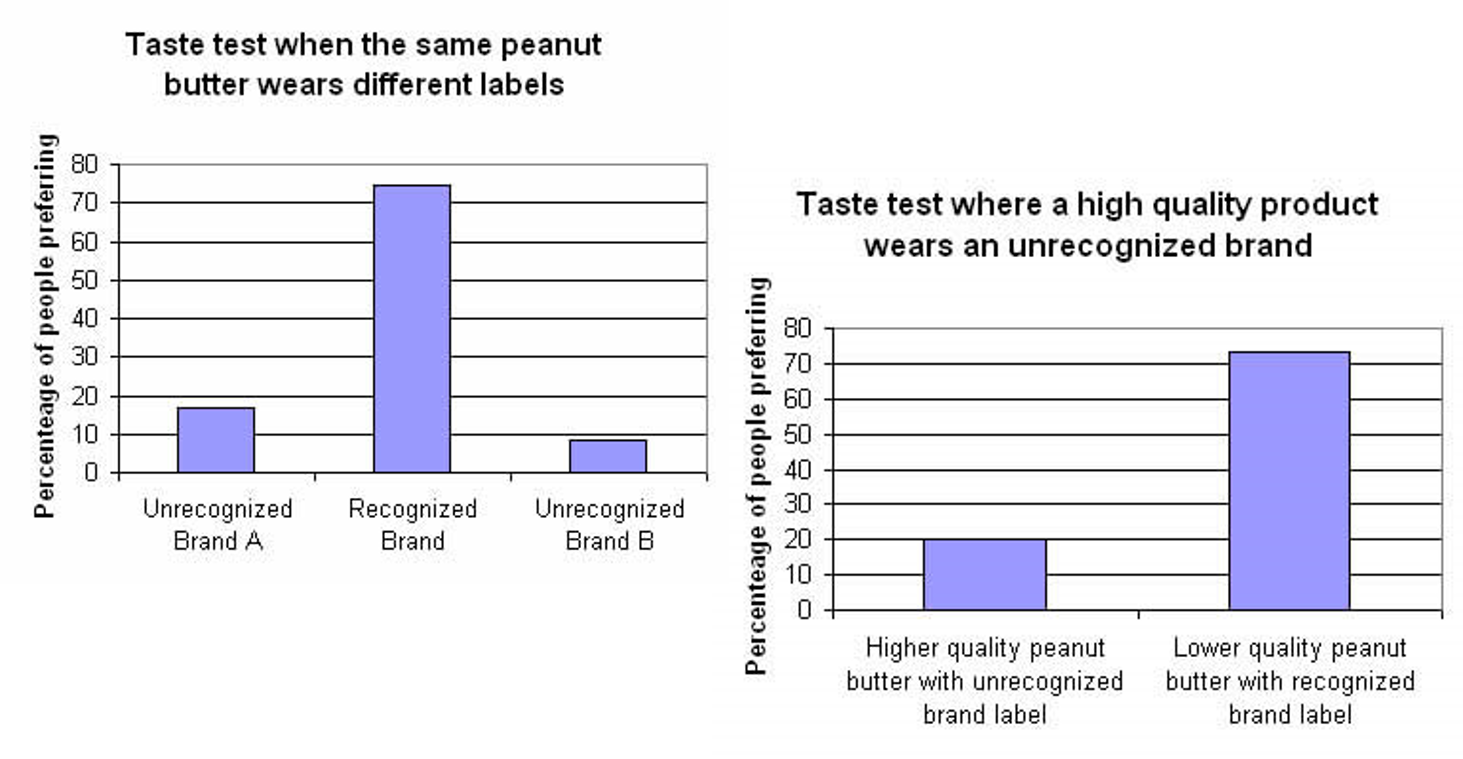

1. Credibility

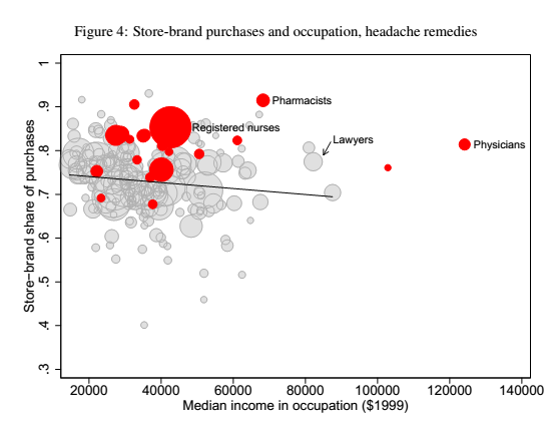

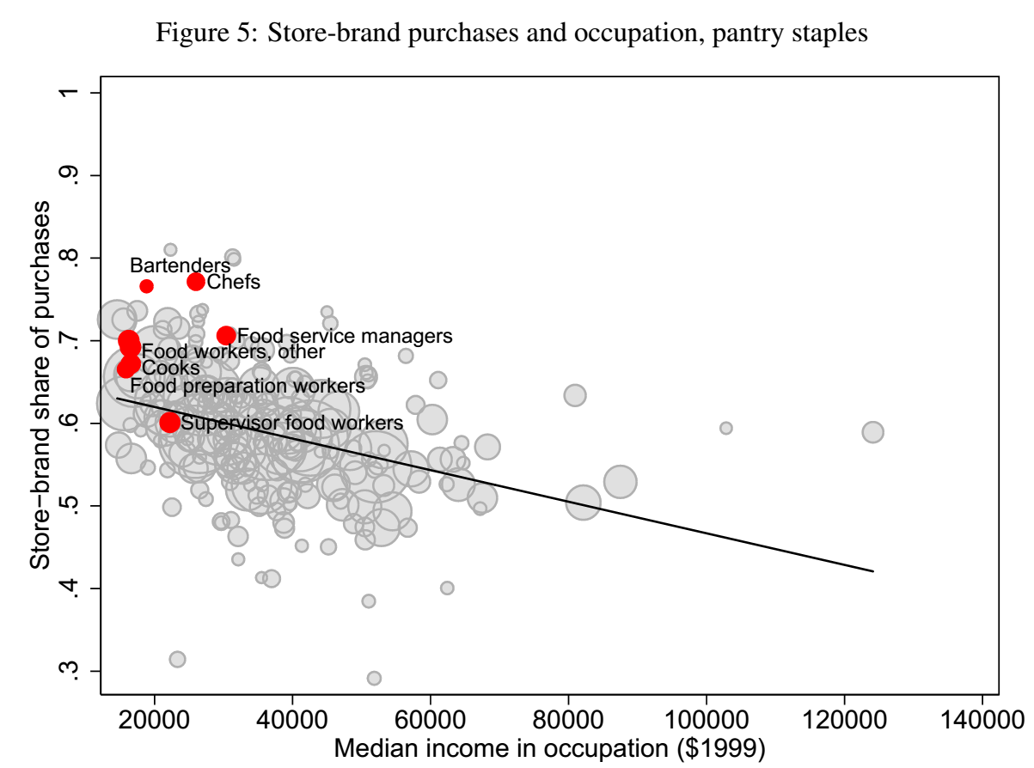

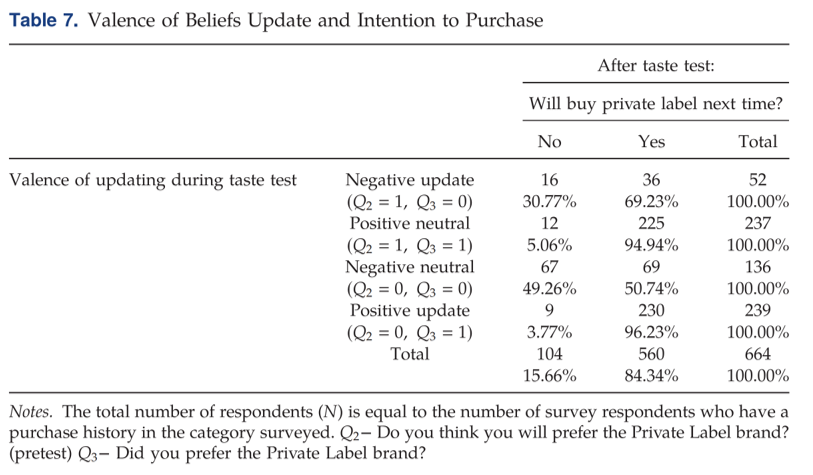

What happens when consumers gain knowledge?

- Bron. et al. (MkSc 2020): Intercepted shoppers in-store

- First, a survey, including:

- Q2: Do you prefer private label or nat’l brand? (PL=1)

- Then, a blind brand/PL taste test, followed by

- Q3: Which did you prefer? (PL=1)

- Q4: Will you buy PL next time?

PL Share among Surveyed Shoppers

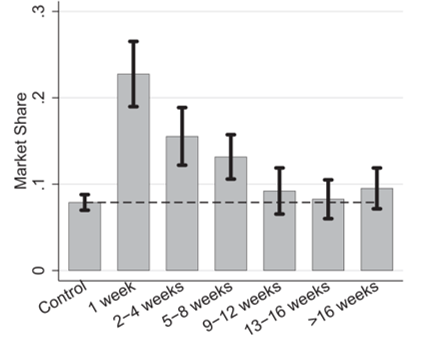

1. Credibility : Takeaways

- Less-knowledgeable consumers are more likely to pay the brand premium

- Recognized brands assumed better/safer than alternatives

- Informing consumers can change brand/PL sales

- Changes may be transitory

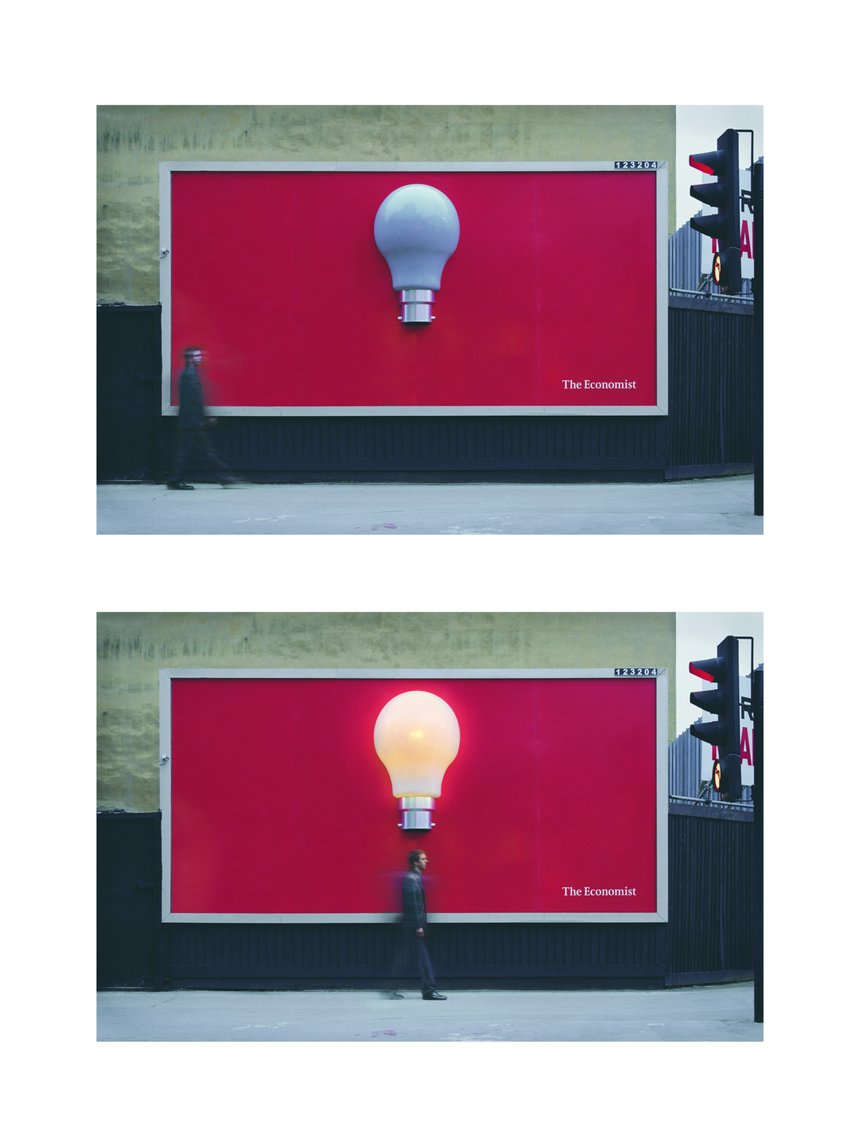

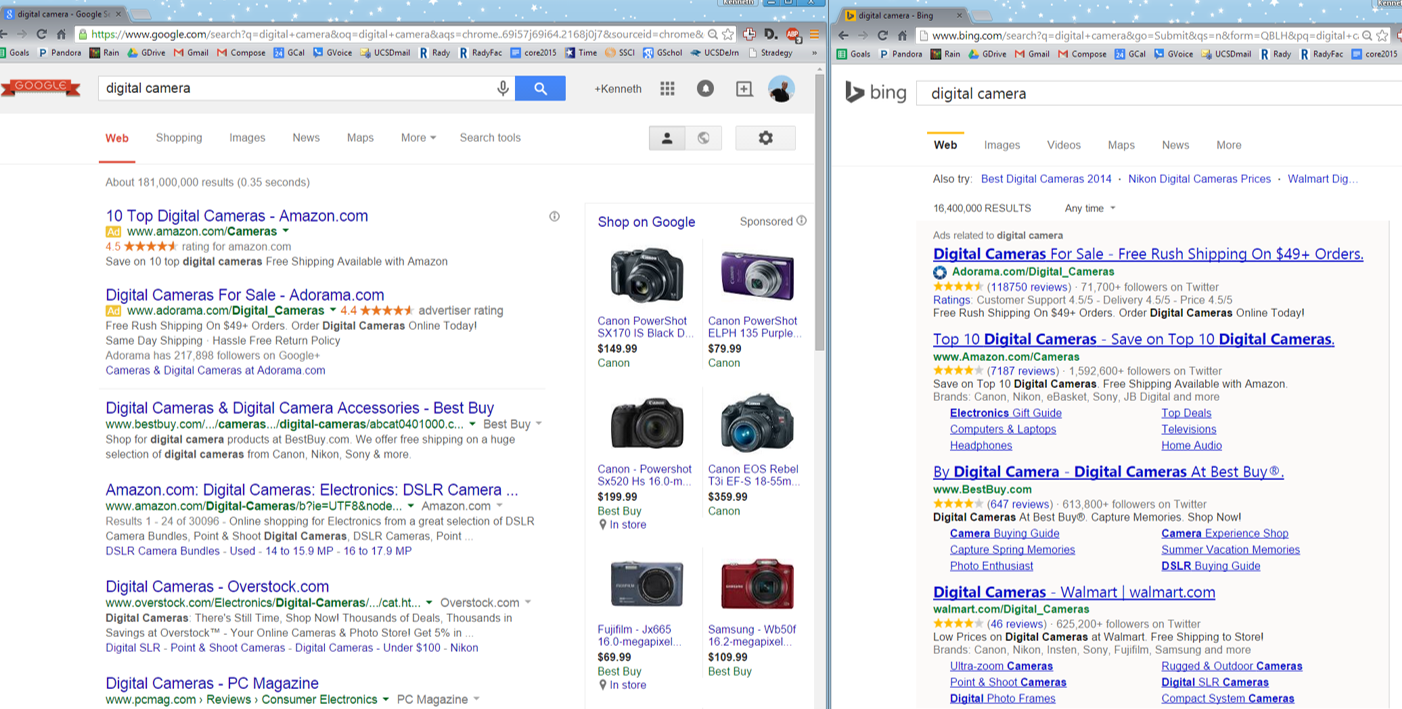

2. Rapid communication

Names and graphics

- facilitate understanding

- call attention to differentiating attributes

What is the value proposition?

3. Personality & Self-expression

Brands can

Express shared identities: UC San Diego, San Diego Padres

Personify seller attributes, eg Jordan Brand, Kylie Cosmetics

Common brand “personalities”

- Classic/sincere, eg Hallmark, In-n-Out

- Competent, eg IBM

- Exciting/fun, eg Snapchat, Scion

- Sophisticated, eg Tiffany

- Calm/peaceful (more common in East Asia)

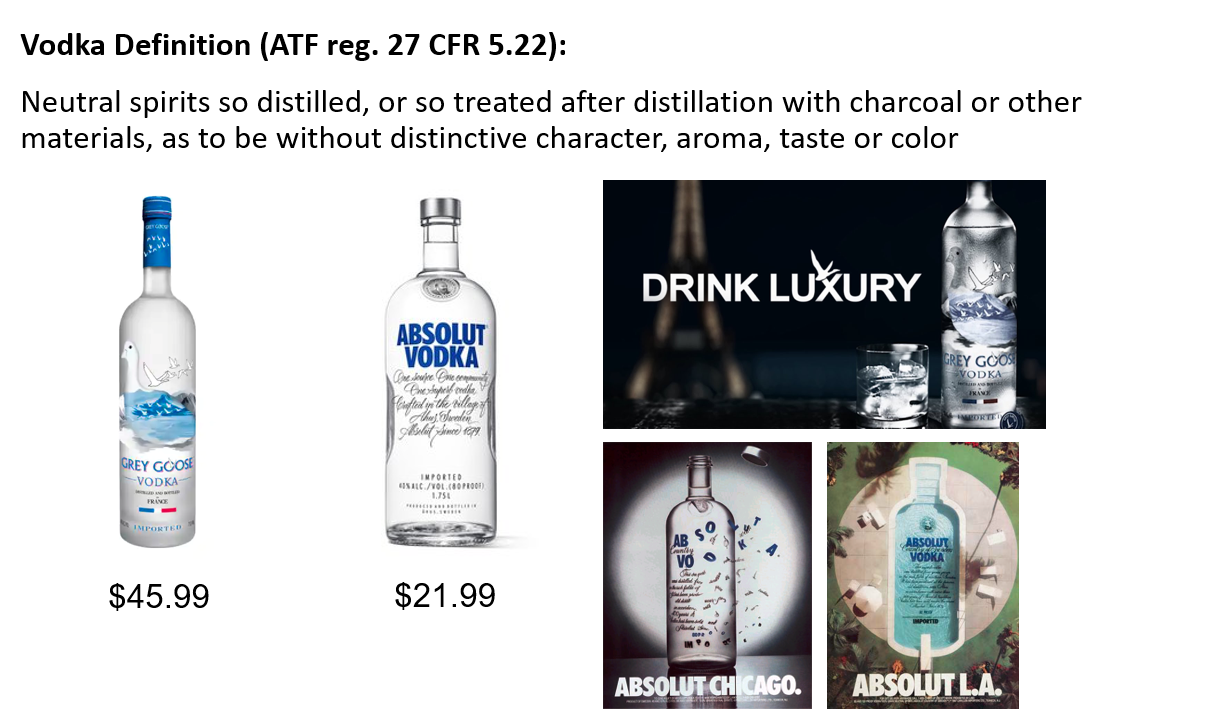

4. Gestalt

Creating artificial differentiation

What’s in a name?

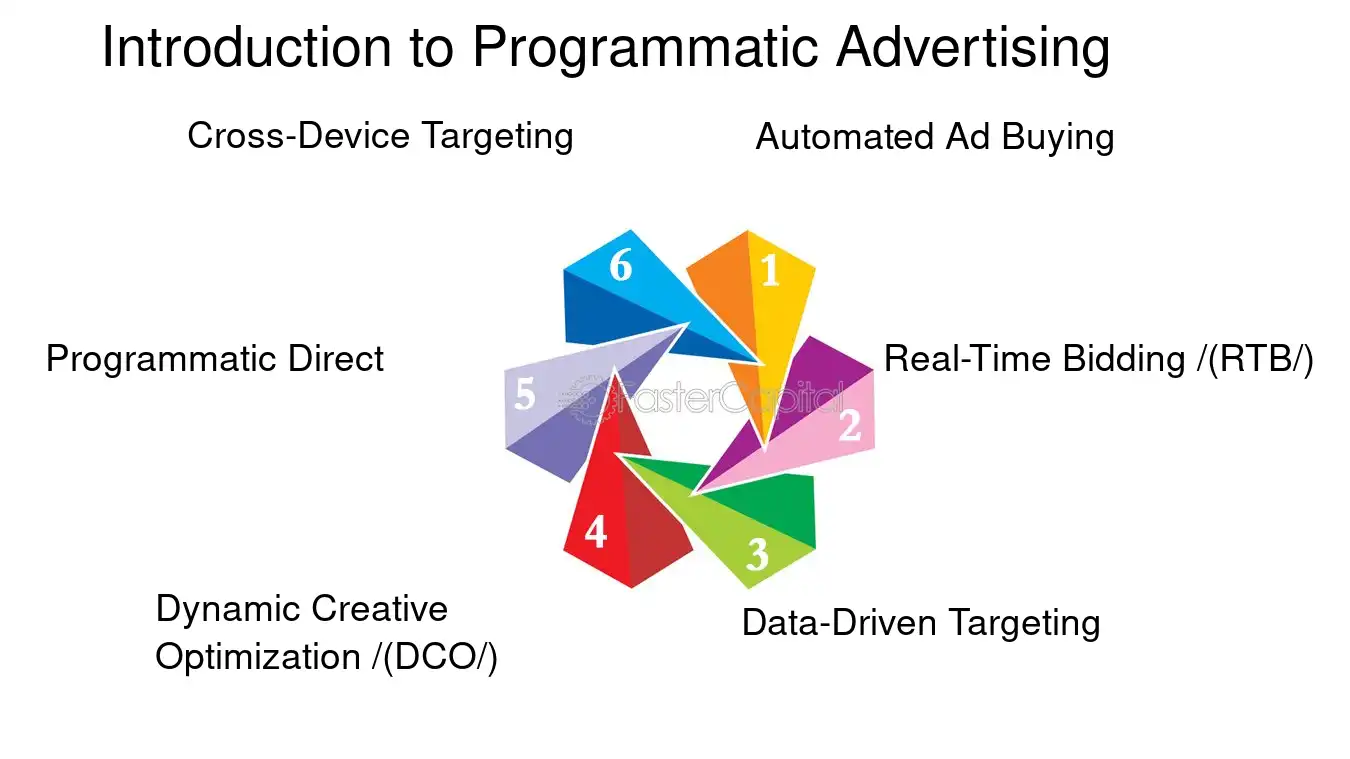

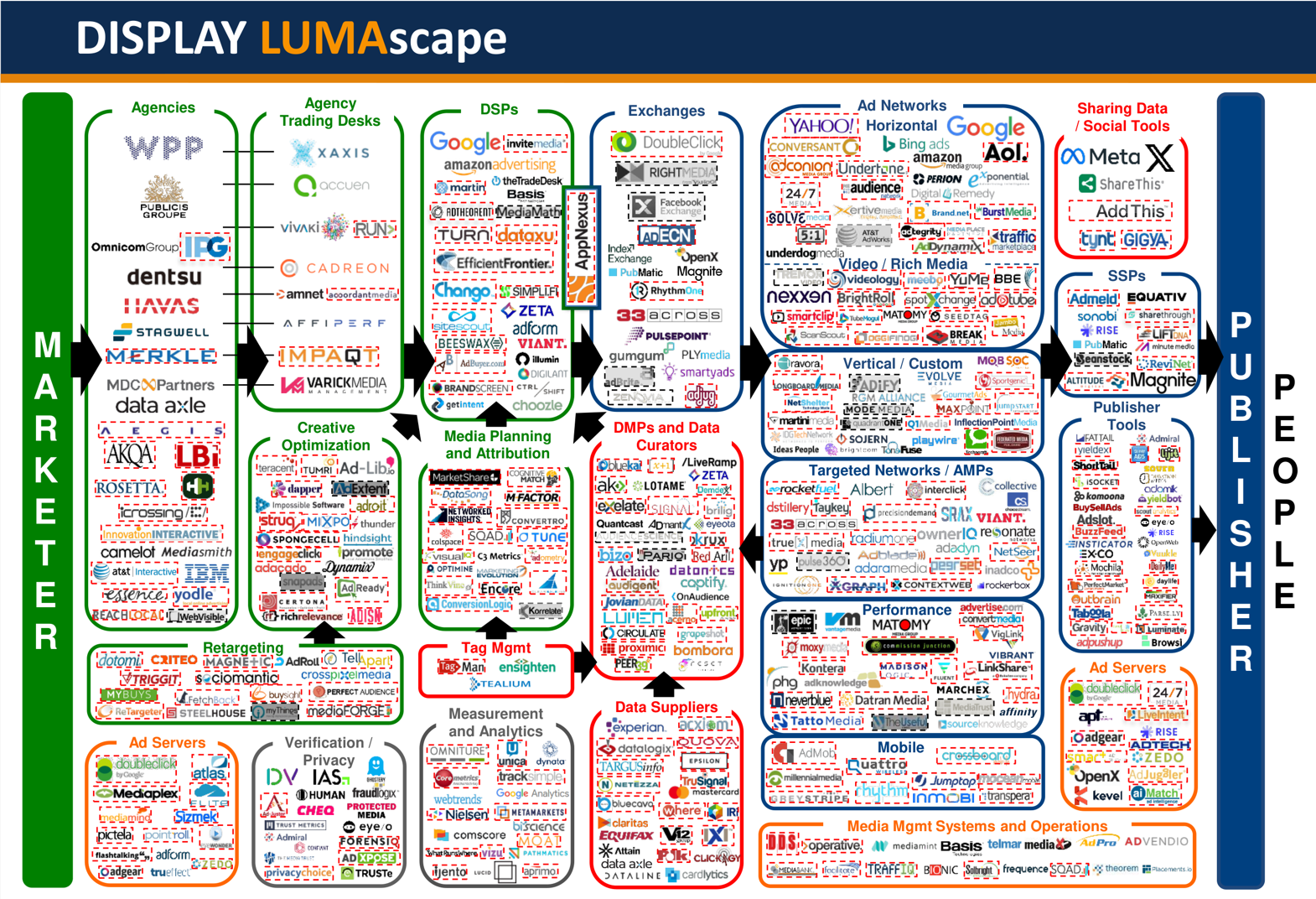

Brand Ads vs. Performance Ads ?

Brand is Dead?

Programmatic downsides

Infrastructure maximizes correlational returns

Attribution/credit “stealing”

Many relevant outcomes: Difficult to measure

Goliath sellers, illegal monopolies, enshitification

Fraud, Algorithmic opacity, Privacy regulations

“Ad Tech Tax” : 20-50% of ad spend

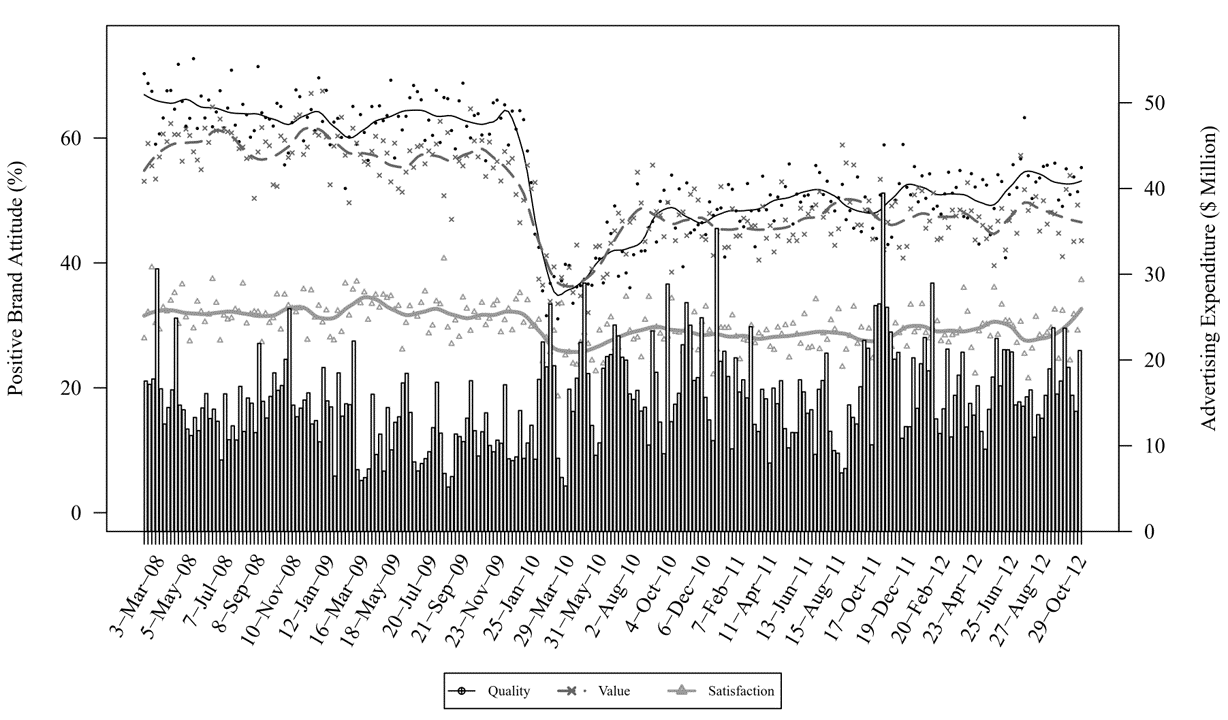

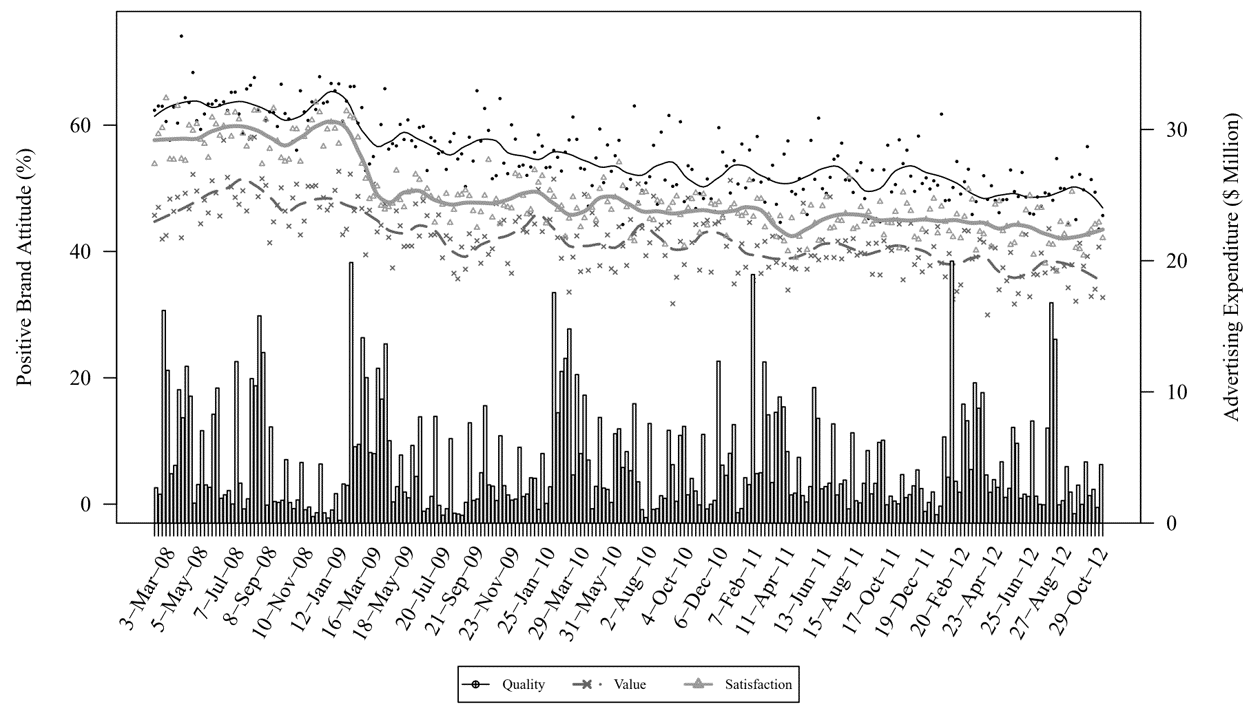

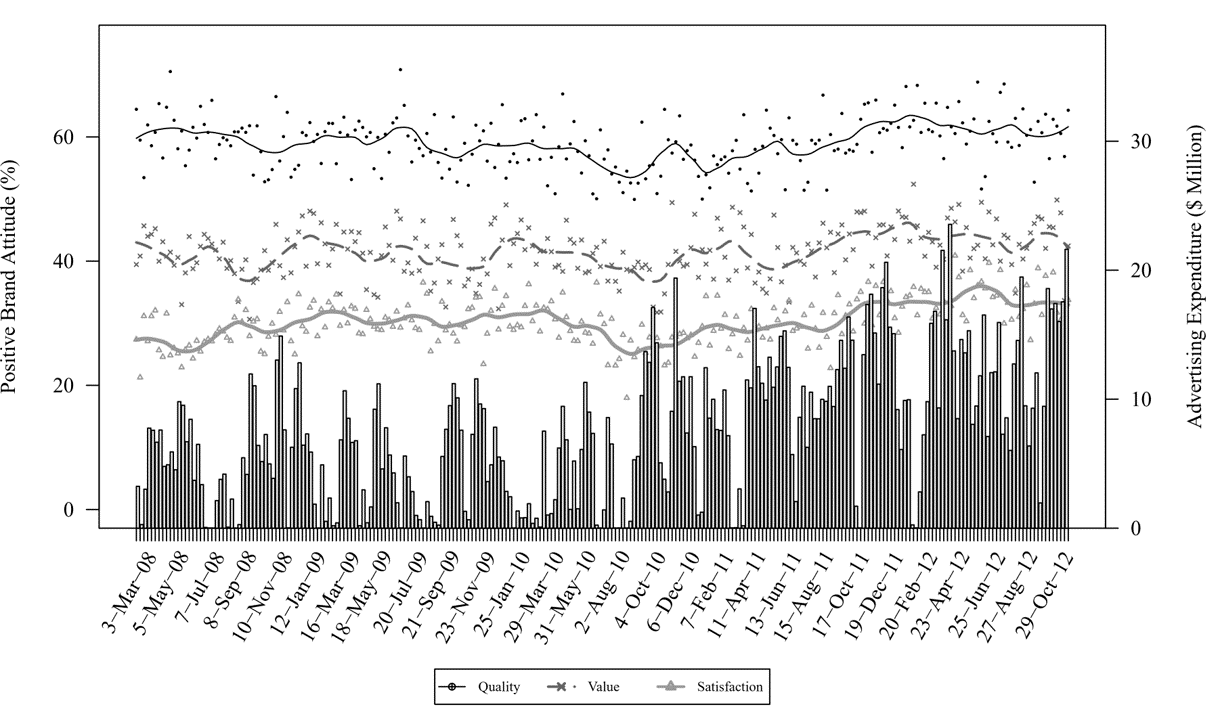

Does advertising build brands? Toyota

Does advertising build brands? Coke

Does advertising build brands? Apple

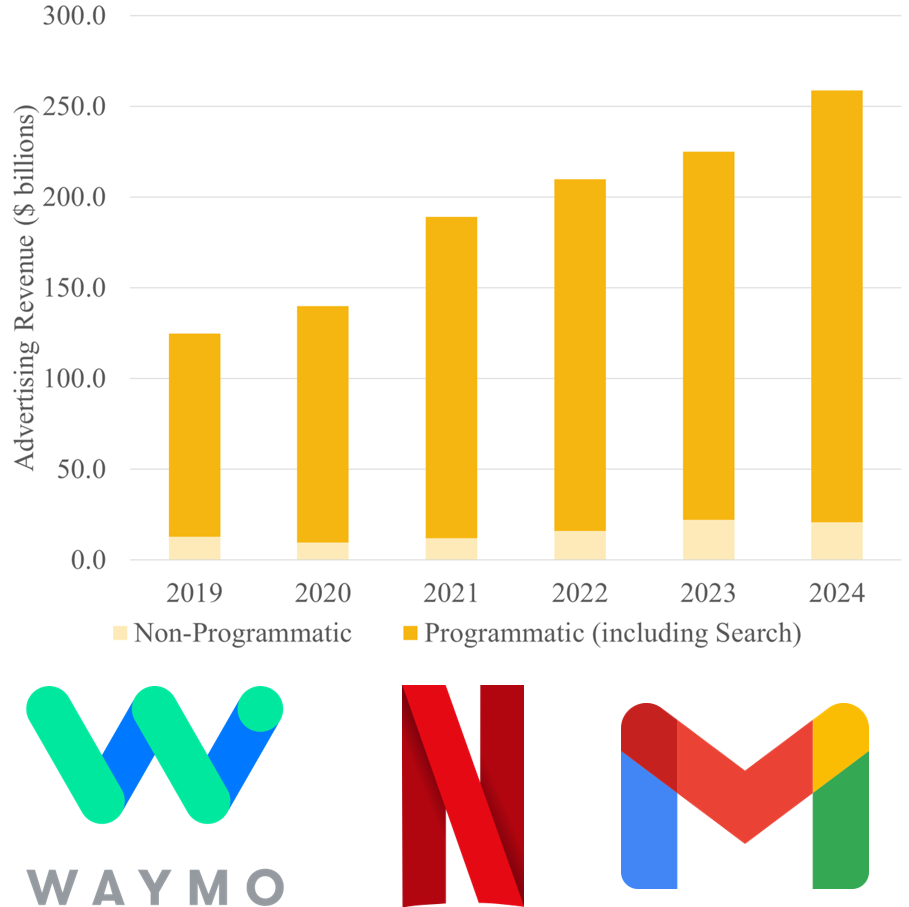

Advertising and brand attitudes

- We analyzed $264B in ad spend by 575 brands in 37 categories over 5 years

- Findings:

Own advertising increases brand perceptions

Competitor advertising decreases brand perceptions

- Advertising looks like a prisoner's dilemmaMassive data needed to estimate precise effects

Ads Measurement Approaches

Marketing Mix Models

Multi-touch Attribution

Incrementality Testing

- Marketers' word for experimental/causal lift - A/B/.../n testing, geo-lift tests, going-dark designsQuasi-experiments

- Instrumental variables, synthetic controls

Tying Things Together

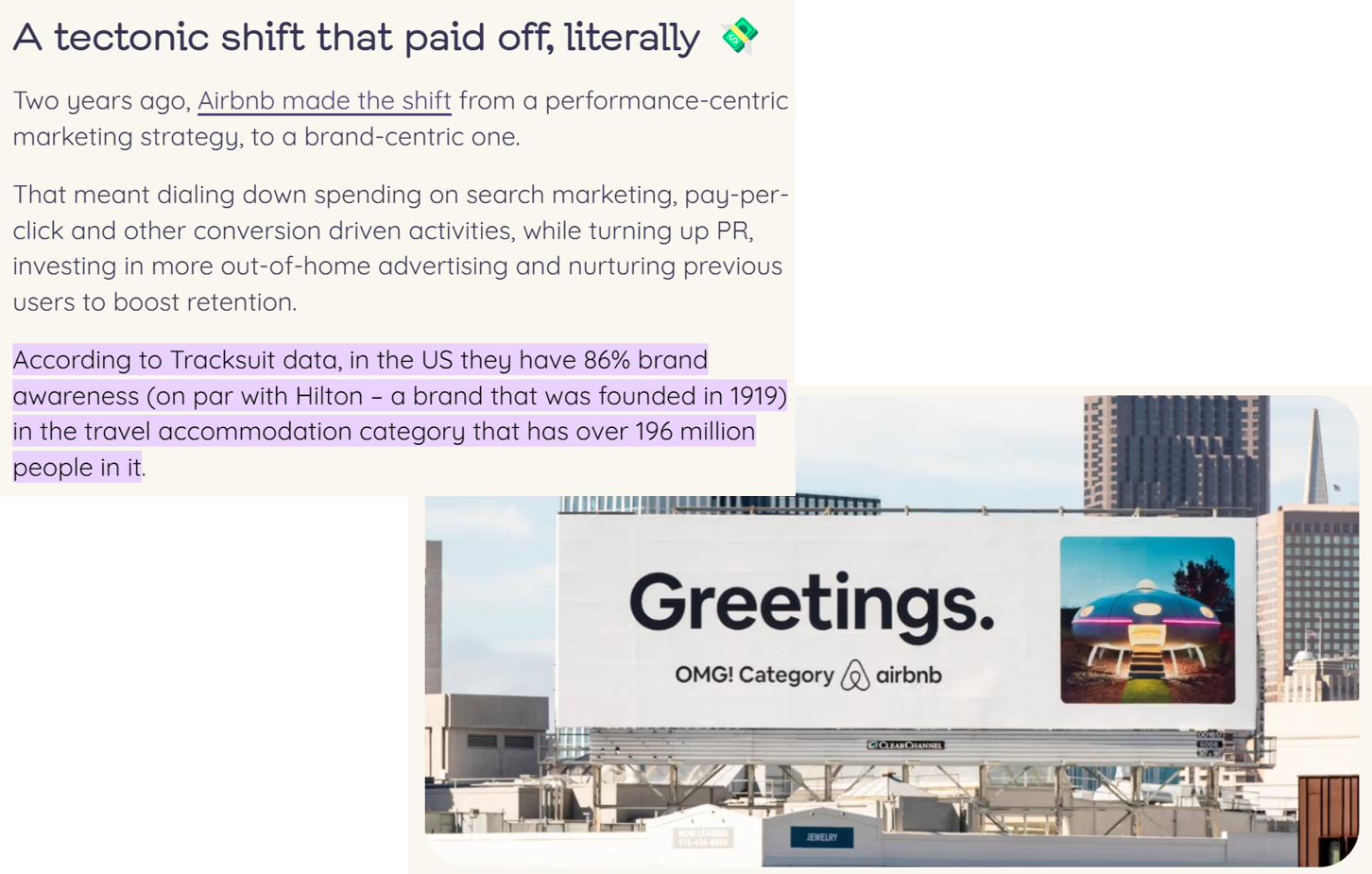

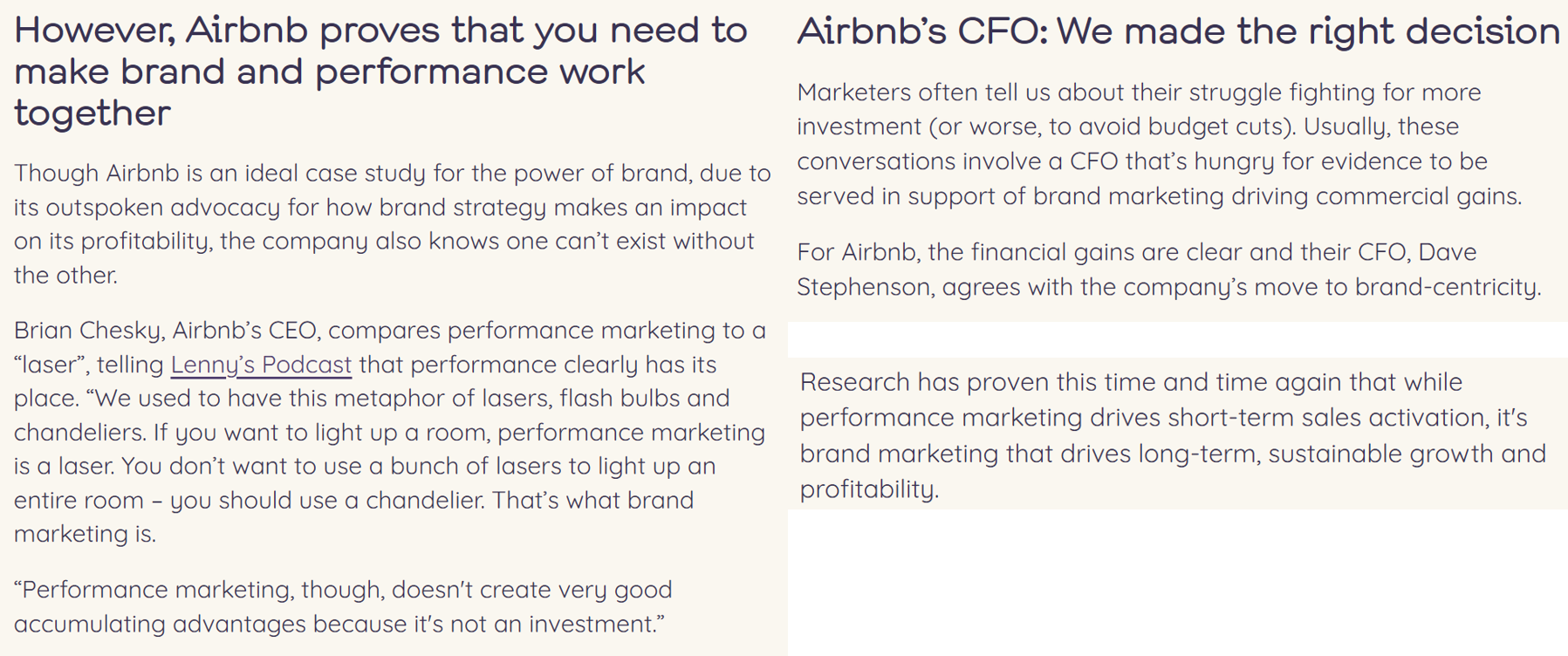

Brand advertising

- Should make performance ads more effective - Long-term, high-cost, requires strategic commitment - Hard to measure incremental returns - Possible to measure correlational returnsPerformance advertising

- Highly targeted, low-cost, short-term, no attachments - Definitely possible to measure incremental returns - Pray to the algorithmic overlordsPopular theory: More brand ads in “search markets,” more performance ads in “selection markets”

- Search markets: Consumer actively searches, eg car insurance - Selection markets: Consumer chooses from a set, eg grocery store

Toolkit: Find wtp for sponsorship

We can pay a celebrity brand \(\$W\) to sponsor our phone. Conjoint estimates indicate the sponsorship will increase phone brand utility from \(\hat\beta\) to \(\hat\beta'\). Should we do it?

Let \(\pi_0=q_j(p_j-c)\) be current contribution

Let \(q'_j(p_j)=N \hat{s}'_j(p_j)\) be celebrity-sponsored demand

Calculate \(\pi_1=q'_j(p_j)(p_j-c)\)

- \(\pi_1-\pi_0\) is pure demand effect of celebrity association

Find new optimal price \(p'_j\) for demand \(q'_j(p_j)\)

Calculate \(\pi_2=q'_j(p'_j)(p'_j-c)\) ; associate with celebrity if \(\pi_2-\pi_0>W\)

Discuss: What if celebrity’s threat point is to associate with a competitor?

Discuss: What if celebrity association persists multiple years?

Discuss: What if 20% chance a celebrity scandal reduces \(\hat\beta'\) to \(\hat\beta''\lt\hat\beta\)?

Class script

Two-dimensional grid search to optimize S1 and S2 prices simultaneously

Assess profit effect of celebrity affiliation with brand, without price reoptimization

Assess profit effect of celebrity affiliation, with joint price reoptimization

Wrapping up

Recap

- Brands are consumer associations between company assets (products, trademarks, etc) and related concepts

- Mental real estate: We can influence it but we don’t own it

- Brands work by establishing credibility, rapid communication, personality/self-expression and gestalt

- Brand/performance advertising debate trades off LR correlations vs. SR increments

- Demand models can quantify returns to brand investments

Going further

Revenue Premium as an Outcome Measure of Brand Equity (JM 2003)

Advertising and brand attitudes: Evidence from 575 brands over five years (QME 2019)

Consumer Misinformation and the Brand Premium: A Private Label Blind Taste Test (MkSc 2020)